The SPDR S&P500 ETF is the biggest and oldest Exchange Traded Fund in the world. It tracks the S&P500 and ETF’s can be a popular choice for investors due to the diversification and low fees that they typically offer.

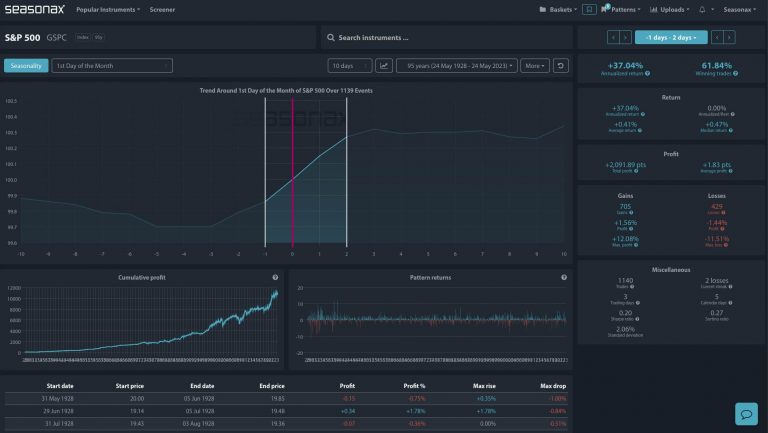

The SPDR S&P 500 ETF has a marked seasonal pattern that could potentially make the case for more patience for value dip buyers in US stocks. The fund tends to do very well from the end of October into the end of the year.

From October 25 through to December 31 the ETF has gained 20 times and only lost value 5 times. The average return has been nearly 5% with the best years in 1997, 1998, and 1999.

Is patience the best approach to take before buying this recent dip in US stocks?

Major Trade Risks:

If the US heads into a deep recession then stocks could be in for a tough time despite the strong seasonal pattern.

Analyse these charts yourself by going to seasonax.com and get a free trial! Which currency pair, commodity, index, or stock would you most like to investigate for a seasonal pattern?

Remember, don’t just trade it, Seasonax it !