One of the nicknames for copper is ‘Dr Copper’ due to the ability of the asset to diagnose the health of the global economy. Copper is a key commodity used in expanding and growing economies, so copper demand tends to bode well for global economic health.

At the moment there are some mixed global signals. US jobs data is good, but the last US NY Empire State manufacturing survey was a dire miss. The People’s Bank of China cut interest rates on Monday, considered offering guaranteed bonds to certain developers on Tuesday, but COVID cases are high and retail sales data was a big miss.

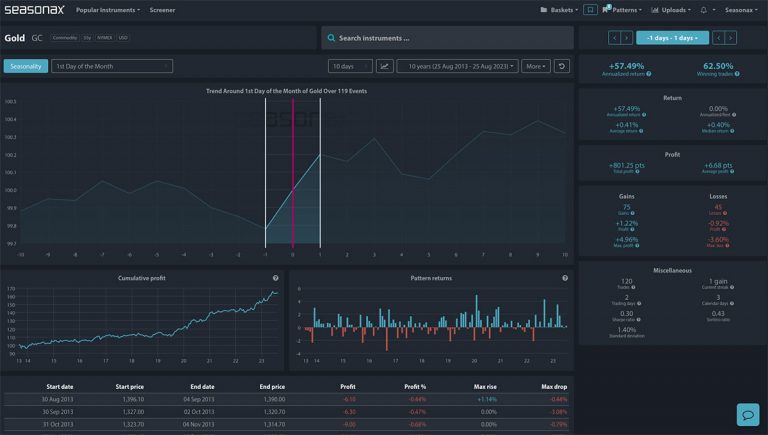

So, how will Dr Copper move over the coming weeks? Will copper be able to put in its seasonal gains? If global sentiment suddenly shifts more clearly positive then watch for copper gains in line with its seasonal strength.

Major Trade Risks:

Global growth may suddenly shows signs of a slowdown and risk assets can quickly fall. Remember, bull markets take the stairs (gradually climb), but bear markets take the elevator (quickly fall).

Analyse these charts yourself by going to seasonax.com and get a free trial! Which currency pair, commodity, index, or stock would you most like to investigate for a seasonal pattern?

Remember, don’t just trade it, Seasonax it !