There is a big question in markets right now about whether or not the Fed futures rate curve is a fair reflection of what it to come for the US.

Are investors too complacent about a retreat from US peak rates? Are investors making the same mistake as the Fed, expecting inflation to fall too quickly? Will rates really fall 150/200bps from 5% down to 3.5% for the summer of 2024? Are investors making a mistake pricing this like a regular recession rather than an inflationary one?

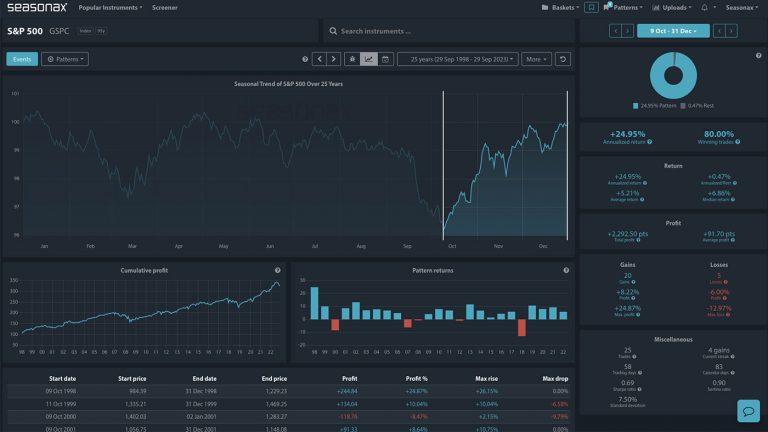

These are legitimate questions and tomorrow the Fed may give us their verdict. If Powell leans dovish in any way, affirming confidence in falling US inflation and/or affirming rate markets path then we could see a Christmas rally higher in the S&P500 in line with the strong seasonal rally

Is Powell set to give an early present to S&P500 prices?

Over the last 15 years the S&P500 has risen 14 times and only lost value once between Dec 14 and Dec 31. So, if Powell does give a Christmas gift through a dovish message then watch for a Santa Rally in the S&P500!

Major Trade Risks:

The biggest risk here is if Powell affirms a higher and for longer rate path ahead from the Fed. That would likely pressure the S&P500 lower and would be in conflict with the S&P500’s strong seasonals.

Remember, don’t just trade it, but Seasonax it.