Tesla’s earnings are due out after the close on Wednesday and there is a lot of anxiety around the stock market right now with very few holding a bullish position.

Tesla has been embarking on a large cost cutting plan recently cutting prices for the Model Y five times this year already. This has meant a 24% reduction in cost for the Model Y since January. Furthermore, Model Y is also eligible for the $7,500 federal tax credits which means that the Model Y can now be had for 10% less than the average price of a new vehicle sold in the US.

So, will Tesla’s attempt to grab more of the US’s SUV market share pay off?

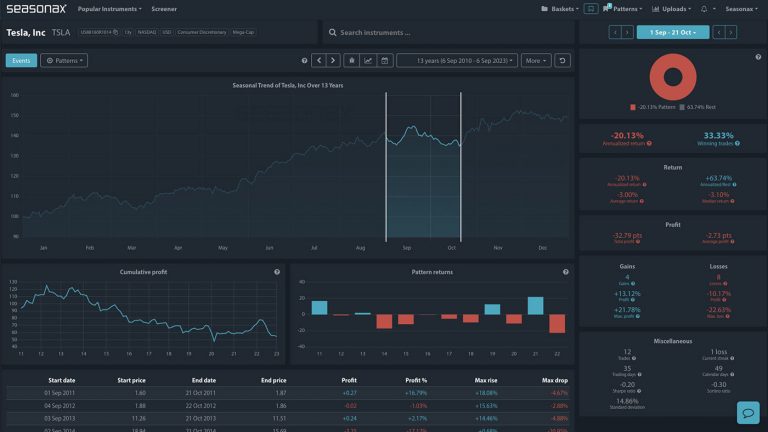

Seasonally there is a mixed period ahead. Typically the second half of April has been a weaker time for Tesla’s shares, but the summer months have shown a stronger bias towards gains.

How will Tesla’s shares perform over this earnings seasons? Remember the Federal Reserve meet early in May and that will give stocks the next clear catalyst when investors know just how firm the Fed will be in its ongoing inflation fight.

Major Trade Risks:

The major trade risk here is that earnings show concerning signs or that investors are worried about Elon Musk’s latest announcement that he would like to launch a rival chat GPT AI to rival Microsoft and Google. How many projects can Musk actually manage?

Remember, don’t just trade it, but Seasonax it!