So, the Fed hiked by 25 bps as expected on Wednesday and also signalled a rate pause with a meeting by meeting basis on the future path of hikes.

In the announcement accompanying the hike the central bank removed language suggesting the possibility of further policy tightening.

Gold gradually moved higher after the Fed decision although much of the decision was already priced into markets. However, with key US jobs data on Friday, Inflation data next Wednesday, will they provide a catalyst to send gold higher?

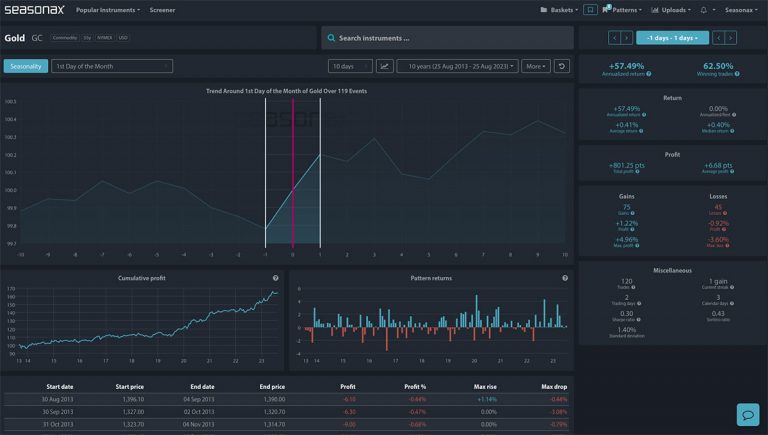

Looking at the event studies we can see that over the last 25 years gold has clearly seen a bias for gains after the Federal Reserve has hiked rates. So, is gold primed for a breakout higher now?

Major Trade Risks:

The major trade risk here is if labour data comes in very tight on Friday and inflation strong on Wednesday next week as both of these events would likely pressure gold

Remember, don’t just trade it, but Seasonax it!