The Federal Reserve is focusing very intently on the US labour market for signs that their rate hiking cycle is starting to cool demand. The way the market has been translation US economic data over the last few weeks is that ‘bad economic news is good news for US stocks’. The logic is that a slow down in the US economy will mean lower interest rates and easier economic conditions for US companies, so bad news supports stocks….for now.

On Friday we have the US NFP print and markets are expecting a further slowdown in jobs. However, if the slowdown is more marked than is currently expected then watch for that bad news becoming good news for stocks. The Markey’s minimum expectations for headline jobs is 40K, so a reading below that will be a surprise.

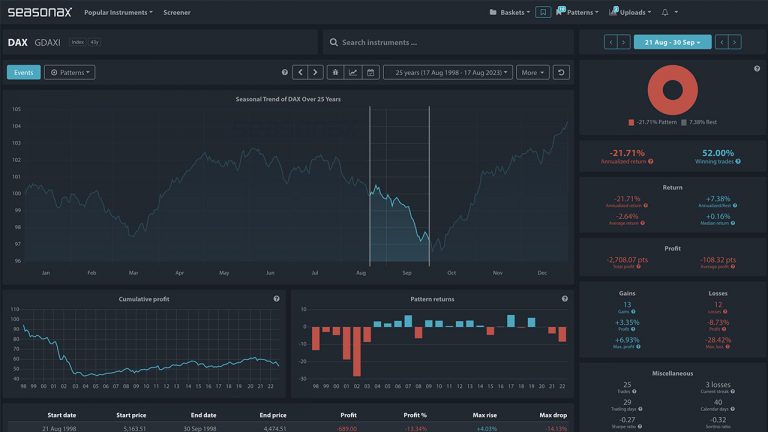

Looking at the seasonality of the S&P 500 around the turn of the month is really interesting from the day before to 2 days after the month end. The S&P 500 has had an average return of 0.41% and over 60% winning trades over the last 95 years, so if we do see a big miss in the NFP job headline, then it would not be unreasonable to expect the S&P 500 to gain into Friday’s close and follow through with those gains on Monday.

Major Trade Risks:

The major trade risk is that eventually ‘bad news becomes bad news!’ and also that prior seasonal patterns do not necessarily repeat themselves each year.

Remember don’t just trade it, Seasonax it!