A series of interest rate hikes from the Federal reserve has kept the dollar bid continually this year. Inflation fears have been the driver of these rate hikes and the dollar long position is showing extreme stretch position in the latest CFTC report. Anticipation is increasing that the dollars recent bull run could be about to come to an end. Let’s see is seasonals light the way here for weakness in the dollar heading into year end.

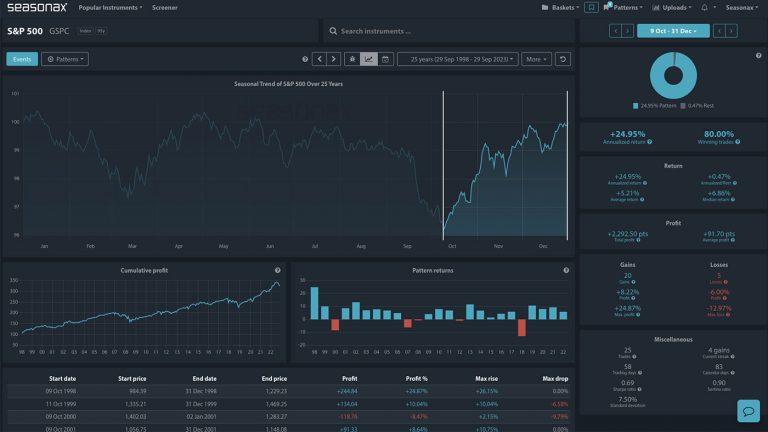

Over the last 25 years from November 21 to December 30 the dollar index has fallen over 70% of the time for an average drop of 1.40%. Are seasonal pointing to the end of the dollars recent bull run?

Major Trade Risks:

The major trade risks here is if inflation remains sticky, the US economy stays strong, and the Fed has to hike rates even higher.

Remember don’t just trade it, Seasonax it!