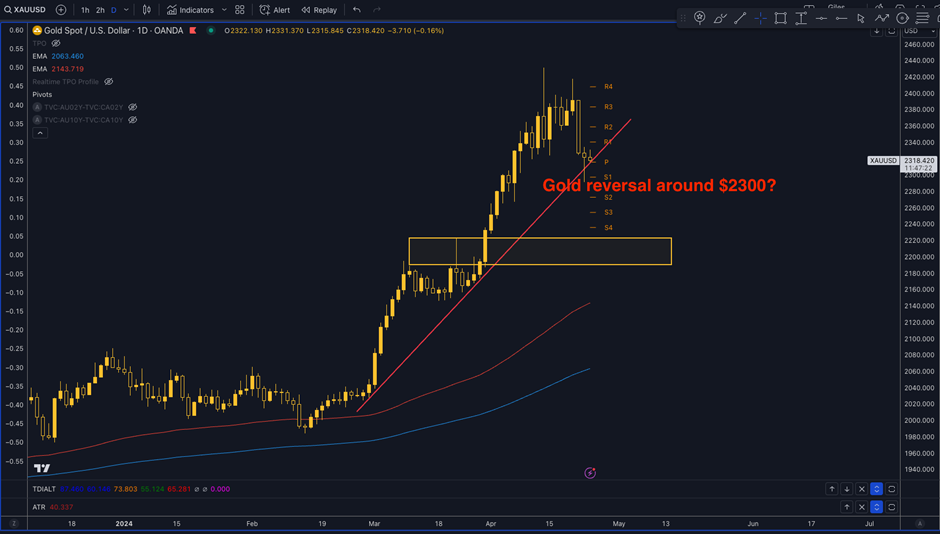

On Thursday at 13:30 UK time (BST) we have the US GDP print which is expected to come in at 2.4%, down from 3.4% in Q4 2023. At the latest Fed meeting the Fed projected GDP to be 2.1% for 2024, so a firm US GDP print underpins the ‘soft landing’ narrative. A very weak print should support gold as in principle it should weaken the USD on rate cut hopes. So, can gold carry on it’s run higher on Thursday and into the US PCE print on Friday?

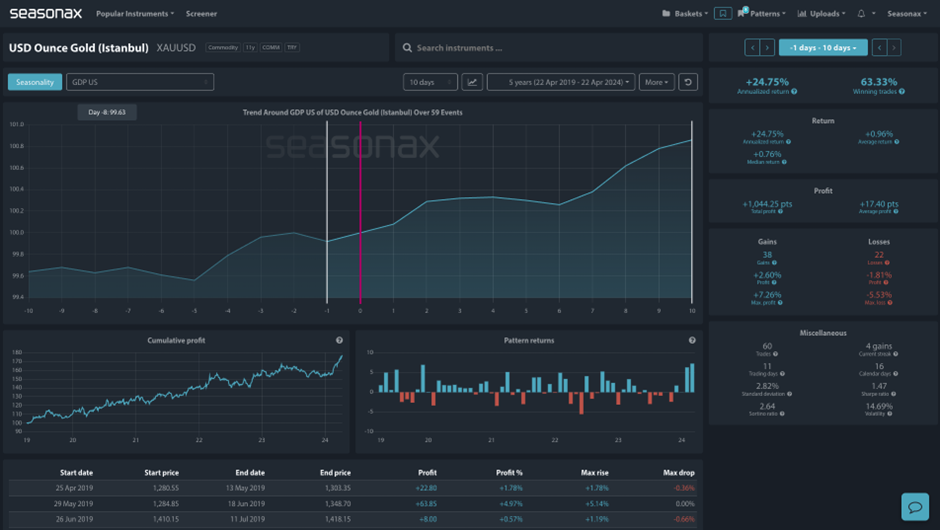

Seasonal risk event analysis shows that gold (XAUUSD) has a bias for gains into and out of the US GDP print. From the day before the GDP release to 10 days after the release the S&P500 has gained an average of 63% of the time with a median return of 0.76% and a minimum gain of over 7% in Feb 2024 and March 2024. So, the recent gains have been noteworthy.

So, will gold find buyers again this time out of the GDP print?

Sign up here for thousands of more seasonal insights just waiting to be revealed!

- The major trade risk here is the US PCE print on Friday, A big beat on Friday will mean the higher for longer narrative will be reinforced and that can be negative for gold. However, if geo-political risk flares in the Middle East again this is likely to be positive for gold.

Remember, don’t just trade it Seasonax It!