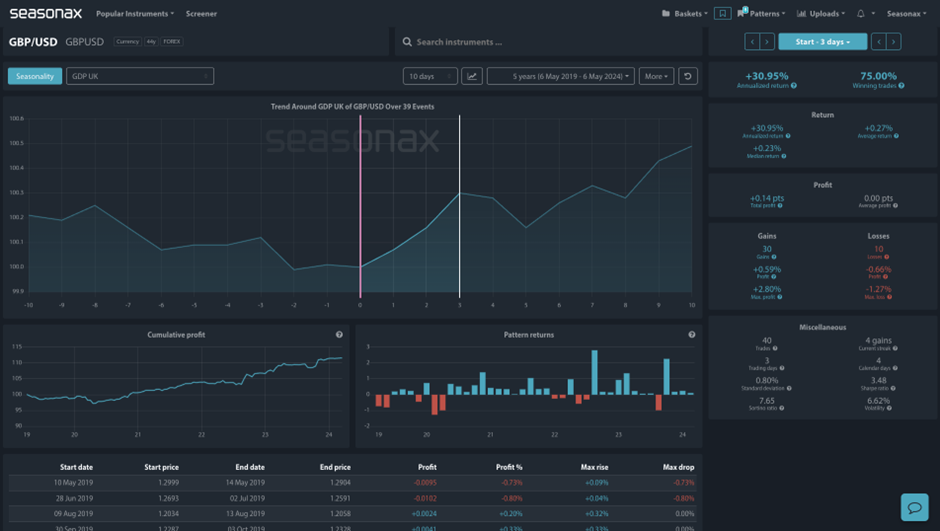

In the Bank of England’s March’s meeting the GBP sold off as two more hawkish MPC members, Haskell and Mann, dropped into voting for ‘no – rate’ change. This allowed the GBP to sell off and market’s want to know this Thursday how warm the BoE are to cutting rates? On the following day we have the UK’s GDP print which is expected to show the UK move out of it’s technical recession.

If the BoE push back against the idea of rate cuts on Thursday, and GDP surprises significantly to the upside, then watch for this seasonal event pattern in the GBPUSD. Over the last 5 years the GBPUSD has gained 75% of the time. The event bias is clearly for GBP upside, so watch out for the GDP event this week as well as the BoE meeting. Technically the GBPUSD is giving mixed signals, so the BoE and GDP prints will be crucial for the next move from the GBPUSD.

Giles Coghlan, CMT is a seasoned financial writer specialising in macro outlooks and key technical trading strategies.

Sign up here for thousands of more seasonal insights just waiting to be revealed!

The major trade risk here is that the BoE signal a dovish outlook and/or the GDP print surprises to the downside.

Remember, don’t just trade it Seasonax It!