China has fallen out of favour with investors in recent months due to competition conflicts with the US and a domestic underperformance. However, Chinese shares have been on a strong run higher recently. The China 50 has hit peaks of a more than 20% rise from early 2024 lows over the last couple of weeks calling some to ask whether this is the time to start investing in China again. Some analysts are pointing to the fact that , despite the ‘bear market’ rally the fundamental outlook has not really changed and economic uncertainty remains with lower earnings set to remain for now. However, other analysts point to very high stock valuations in the US and Japan as a potential driver for a renewed interest in China and likely to encourage a further rotation of funds.

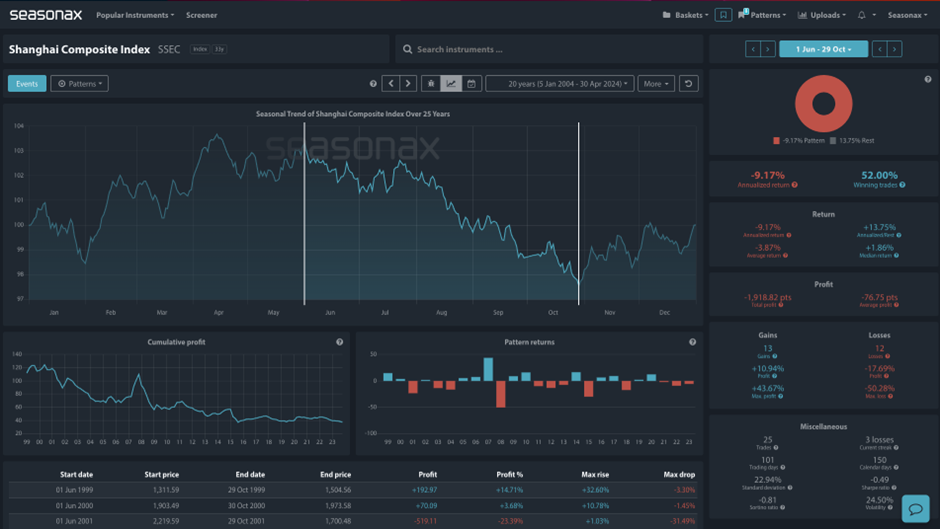

The Shanghai CompositeThe Shanghai Stock Exchange Composite Index (SSE Composite) encompasses all A-shares and B-shares traded on the Shanghai Stock Exchange, serving as a comprehensive gauge of its listed companies’ performance. It offers a broad perspective on the exchange’s activity, while more focused indices like the SSE 50 Index and SSE 180 Index highlight market leaders based on their market capitalisation. So, what can we see seasonally? A weak period is ahead…

Over the last 20 years the Shanghai Composite see’s an average return of -3.87% from June 01 through to October 29.

The Shanghai 50, over the last 20 years, has an average -2.58% fall from May 29 through to October 01.

So, regardless of whether China’s recovery is sustainable or not, is a summer pullback due?

Giles Coghlan, CMT is a seasoned financial writer specialising in macro outlooks and key technical trading strategie

Sign up here for thousands of more seasonal insights just waiting to be revealed!

The major trade risk here is that prior seasonal patterns do not necessarily repeat themselves each year.

Remember, don’t just trade it Seasonax It!