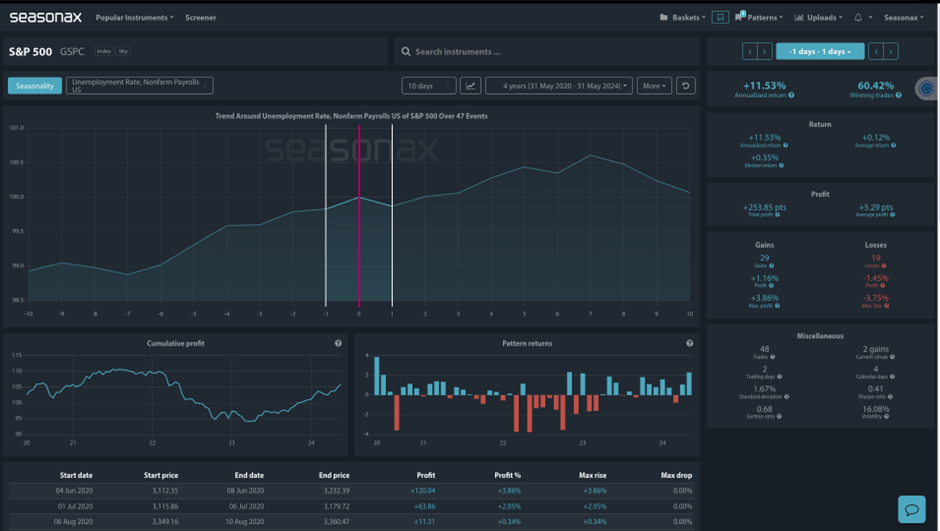

On Friday the latest jobs data will be released for the US and it will be in major focus. Remember, the Fed has a twin mandate: to achieve maximum employment and keep prices stable. So, with inflation moving in the right direction with the latest PCE print. This means that a weak jobs print here could increase expectations of a Fed rate cut. This could give the S&P500 a nice boost higher. This is also where the Seasonax event feature is so helpful. In the last 4 years the S&P500 has moves up on average on the day before and after the US report. Furthermore, we have also seen times when the gains have exceeded 2%, So, this helps set expectations. The maximum gain was on June 04 2022 with a 3.86% gain. However, there have also been large losses – with a number of falls greater than 3% too – so there really is some strong 2 way action around this event – it’s certainly not one to miss!

The weaker US PCE print last Friday has meant the Fed’s labour mandate can take more of a focus with the reading coming in as expected, not showing a tick higher, and the m/m reading slightly lower than expected.

Sign up here for thousands of more seasonal insights just waiting to be revealed!

The major trade risk here is to be aware that the S&P500 volatility is directly linked to the extent of the surprise that is or is not seen in the US labour print.

Remember, don’t just trade it Seasonax It!