GameStop shares have hit the headlines again as GameStop options had their most active session since 2021 on Friday of last week. The shares saw heavy volatility last week as the famous meme stock influencer, Keith Gill, released an enigmatic post on twitter. Shares fell sharply last Friday after Gill’s much-anticipated return to YouTube. The video-game retailer also unexpectedly released its earnings on Friday last week and announced plans to sell up to 75 million additional shares earlier in the day. The stock nearly fell around 40% after Gill’s appearance on the “Roaring Kitty” stream, where he reiterated his views on the stock and confirmed that the large positions recently shown on his Reddit account are in fact his his. Gill who has driven the stock on a wild ride in recent weeks, praised GameStop’s CEO , and expressed confidence in the management team’s ability to transform the business. However, has he done enough? Will markets buy the meme hype or are weak seasonals due to take centre stage?

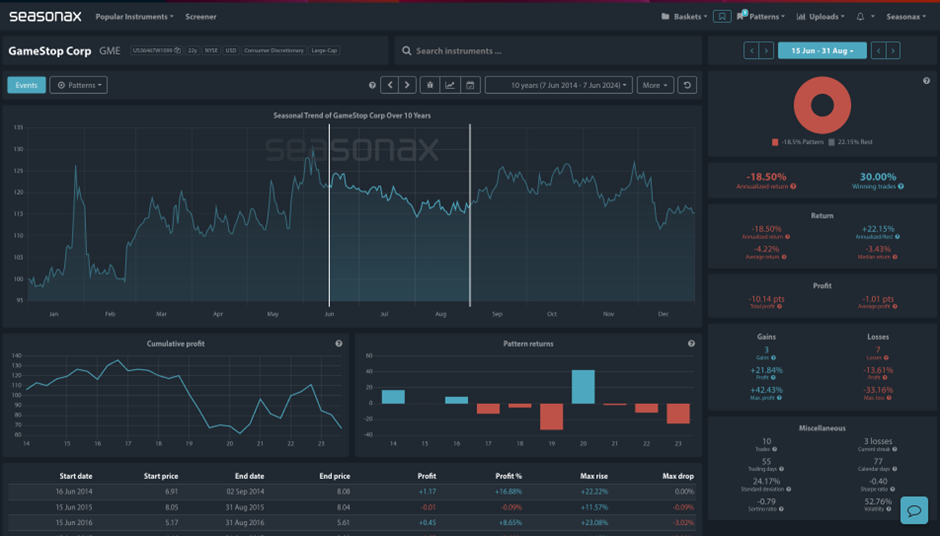

Over the last 10 years GameStop Corp shares have fallen on average 4.22% from June 15 through to August 31. The largest fall was in 2019, with a 33.19% loss, but this is a volatile stock. In 2020 GameStop Gained over 40%. So, which will prevail this year? Meme stock hype or a seasonal bias for sellers?

Technically, the GameStop has been driven significantly higher, but the price action is messy – mainly because the stock price is divorced from the underlying business factors

Sign up here for thousands of more seasonal insights just waiting to be revealed!

The major trade risk here is due to the unpredictable nature of the stock as one of the ‘meme stocks’ that can see sudden, unexpected moves with little notice.

Remember, don’t just trade it Seasonax It!