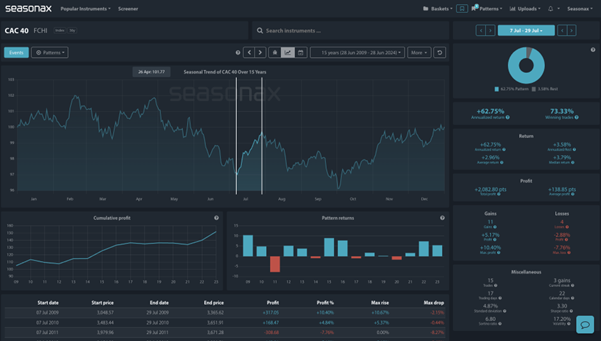

Start of seasonal pattern: July 07

End of seasonal pattern: July 29

Marine Le Pen’s National Rally took the most votes of all the parties with the first round of voting on Sunday seeing them capture 33.2% of the vote. The New Popular Front achieved 28% of the vote and Macron’s coalition only got 20.8%. Despite the risk premium sending the French 40 lower when Macron called the snap election, the markets have rallied to start the week as the National Rally recorded a smaller margin of victory than some polls had indicated. Furthermore, France’s mainstream parties began looking at ways to keep the far right from securing an absolute majority in next weekends elections. It will not be until Monday July 8th that we see the final result of the vote and the reaction in the CAC 40.

However, one thing to note is that seasonally the French 40 has a seasonal period of strength ahead. Over the last 15 years the CAC 40 has gained nearly 3% on average from July 07 through to July 29. The largest return has been in teh double digits and the largest fall just over 7.5%. So, if Marine Le Pen’s National Rally party fails to gain an overall majority, will we see another rally in the CAC 40?

Technically, we can see that the CAC 40 has gapped higher on July 01 after the results of the first round of the French election, so watch this rising window to potentially hold as support this week as marked below from the 7,500 region

The major trade risk here is that previous price patterns do not necessarily repeat themselves each time and if the National Rally do achieve an absolute majority markets will likely perceive that as risk negative and the CAC 40 could fall sharply at the open.

Remember, don’t just trade it Seasonax It!