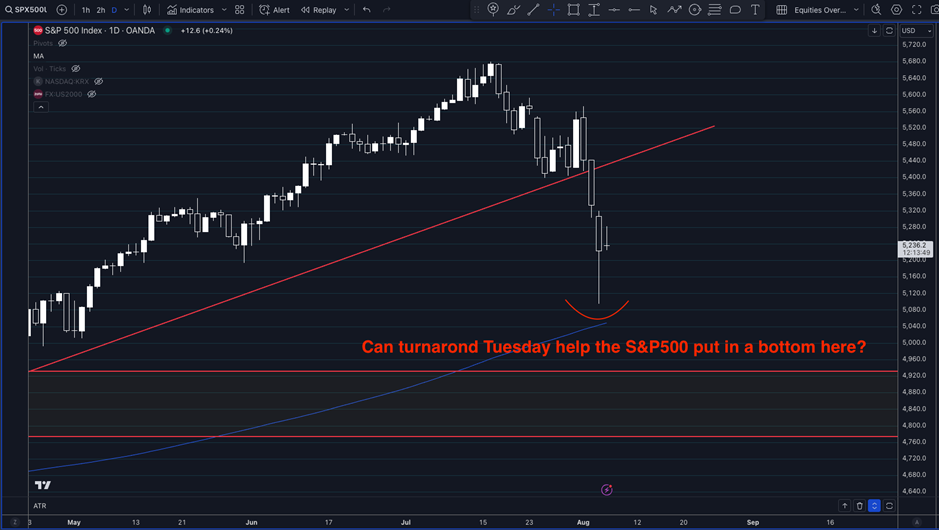

Why Do You Get a Turnaround Tuesday in the S&P 500?

Today, we will explore the concept of “Turnaround Tuesday” in the S&P 500, examining why this pattern occurs and what it means for traders and investors. Turnaround Tuesday refers to the market phenomenon where the S&P 500 and other major indices often reverse their direction on Tuesdays following a significant move on Monday.

The seasonal pattern shows that Tuesday is often the strongest day of the week for gains and many traders have noticed that if the market experiences a sharp decline on Monday, it frequently reverses direction the next day, leading to the nickname “Turnaround Tuesday.” Looking at the S&P 500 over the last fifteen years shows us that Tuesday is the strongest day of the week.

Why does it happen? It probably happens due to psychological factors – By Tuesday, investors have had time to digest and react to news that emerged over the weekend or from the end of the previous week. This digestion period can result in a change of market direction as new information is fully integrated into trading decisions. In this instance the ISM services data on Monday showed a US economy (which is services led) not showing the warning signs that the NFP data flashed on the previous Friday.

So, markets calmed and the Nikkei actually went limit up in overnight trade. So, could this be a near term bottom for this week for the S&P500? Technically speaking, when you see these large wicks on the daily candles (like we had yesterday) they offer show serious buyers and can offer great support areas for intraday traders looking for short term longs.

Sign up here for thousands of more seasonal insights just waiting to be revealed!

Trade risks

- Previous seasonal patterns do not guarantee future seasonal patterns.

Remember, don’t just trade it Seasonax It!