Taiwan Semiconductor Manufacturing Company Limited (TSMC) is coming off a stellar performance in July, with revenue surging by 45%, reaching NT$256.95 billion ($7.9 billion). This impressive growth, driven by strong demand for artificial intelligence chips, especially from major clients like Nvidia Corp., which has raised expectations for the company’s third-quarter results. Analysts now project a 37% increase in TSMC’s revenue for the quarter, with a total of NT$747.4 billion. According to Bloomberg the July figures suggest that TSMC might even exceed these optimistic forecasts.

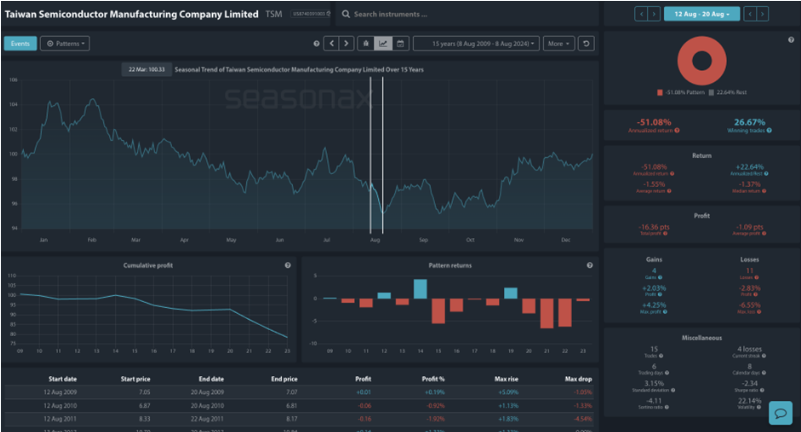

However, despite this recent strong performance, traders should be aware of a historically weak seasonal period for TSMC in mid-August. Over the past 15 years, the period from August 12 to August 20 has seen TSMC consistently underperform, with an annualized return of -51.08% and only 26.67% of trades ending in profit. The pattern returns chart indicates that most of the losses have occurred in recent years, with particularly sharp declines in the last six years.

Given this seasonal weakness, there is a risk that TSMC’s recent positive momentum could stall in the coming days. Investors should be cautious, as historical data suggests that this period has been challenging for TSMC, regardless of the company’s broader performance. However, does this provide a dip worth buying around the 150 level with the latest bullish piercing line pattern on the daily chart?

Sign up here for thousands of more seasonal insights just waiting to be revealed!

Trade risks

- While TSMC’s recent revenue growth is encouraging, the seasonal pattern suggests that the stock may face headwinds in the coming week – if geo-political risk increases this week – or US inflation surges – then we may see more stock selling.

Remember, don’t just trade it Seasonax It!