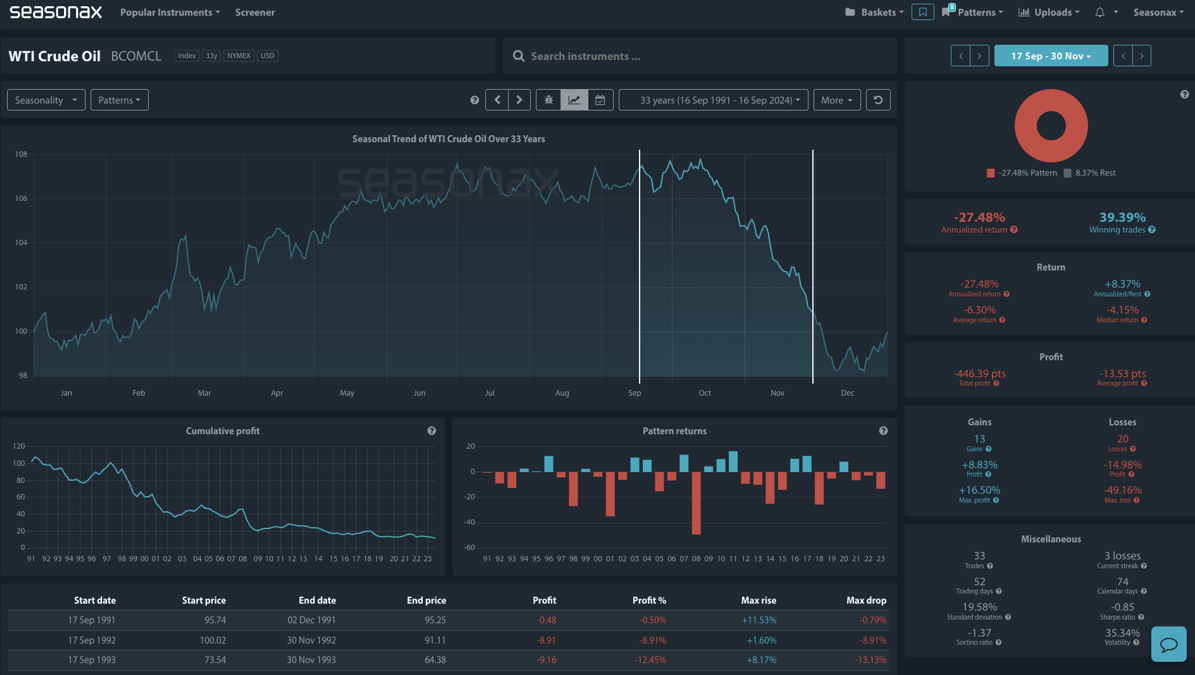

Crude oil prices are facing significant pressure this quarter, driven by China’s economic slowdown and signs of ample supply. WTI crude oil has experienced a notable seasonal downtrend during the period from September 17 to November 30, showing an annualized return of -27.48% over the past 33 years. With only a 39.39% win rate, this period has historically seen persistent selling pressure on crude oil.

However, the current backdrop is complex. Despite the seasonal weakness, crude oil is seeing support from extreme short positioning among trend-following commodity trading advisers, who are close to their maximum short positions. This setup suggests that further selling pressure may be limited, as these shorts could unwind, potentially creating a short squeeze. Additionally, continued supply constraints in Libya and the US Gulf of Mexico, coupled with potential inventory drawdowns at Cushing, Oklahoma, this week, are lending support to prices.

Supply Constraints and Positioning: Key Drivers

While crude oil remains down this quarter, the combination of supply constraints and stretched short positions could shift the market dynamics. EA Quant Analytics notes that the current short positioning may limit further downside, as selling pressure could ease if shorts are forced to cover their positions. Meanwhile, supply disruptions in key regions like Libya and the Gulf of Mexico are keeping a floor under prices, despite broader economic concerns.

Looking Ahead: Will the Short Squeeze Reverse the Seasonal Trend?

Historically, crude oil tends to decline in the final quarter of the year, with losses averaging -6.30% during this period. The largest drawdown recorded was -49.16%, signaling the potential for significant downside. However, with short positioning at extremes and supply-side issues lingering, there may be an opportunity for crude to move higher first. Watch for any sellers to use the $76-80 region to add to any existing shorts. This offers a confluence of resistance levels including the 100/200EMA, the trend line from Oct 2023 and Apr 2024, as well as the big round number of $80.

Sign up here for thousands of more seasonal insights just waiting to be revealed!

Trade risks

- The major risk here is that previous seasonal patterns may not fully account for current market dynamics such as extreme short positioning or unexpected geopolitical events.

Remember, don’t just trade it Seasonax It