Following the recent dovish Federal Reserve meeting, where the Fed confirmed a 50bps rate cut and reduced the dot plot projections, the EUR/USD has maintained a strong buy bias. The Fed’s outlook, which suggests continued dollar weakness, has been further reinforced by lower inflation expectations and rising unemployment projections. This backdrop, combined with the widening yield spread between German bunds and U.S. treasuries, is supporting the case for euro strength.

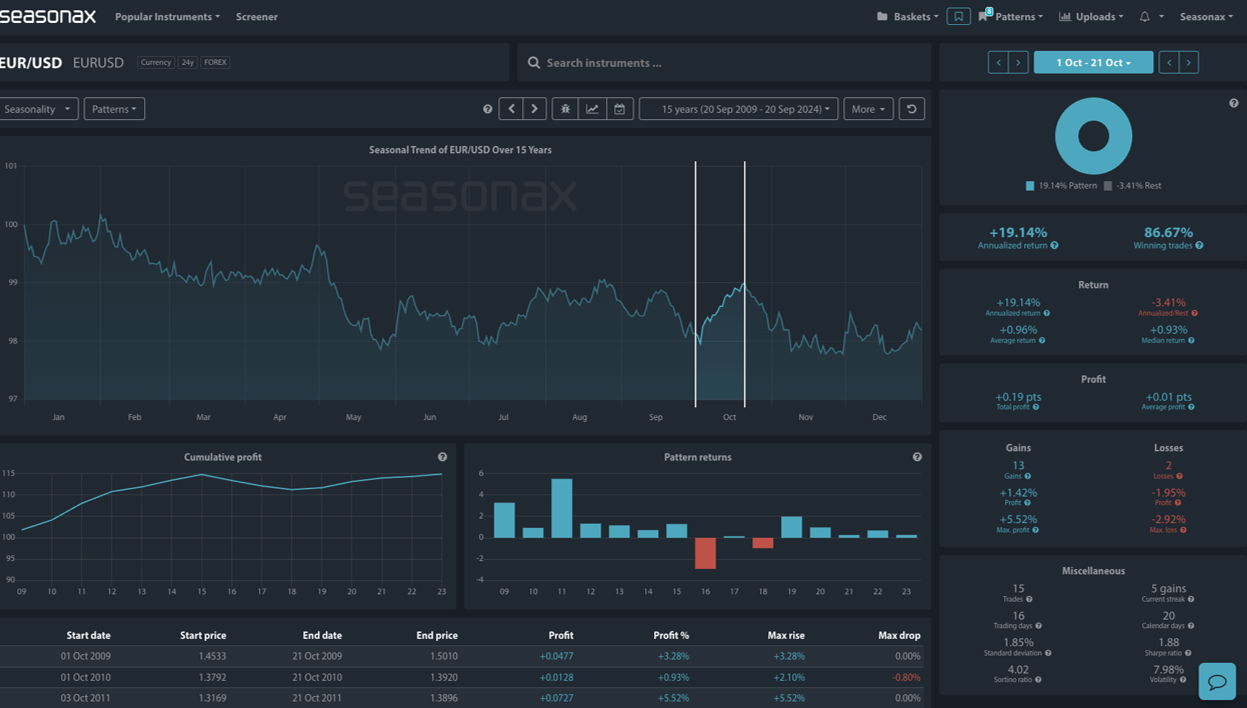

According to the seasonal chart for EUR/USD, the pair has a historically strong performance from October 1 to October 21, with an annualized return of +19.14% and a high winning trade percentage of 86.67%. This aligns well with the current fundamental backdrop, creating an attractive buy opportunity.

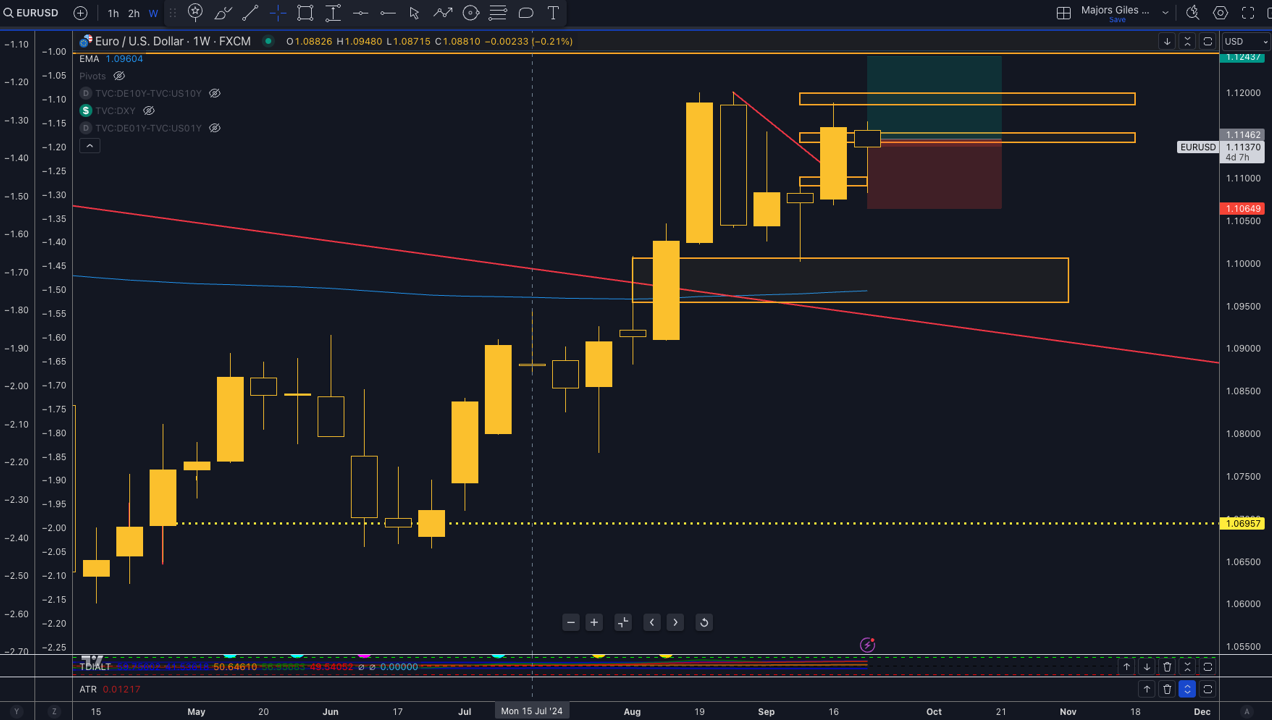

EURUSD Technical Levels:

Traders should monitor the 1.103 support level for buying opportunities, with upside targets around 1.1240 based on historical performance and current market conditions. The seasonality supports this bullish bias, but risks are still present.

Sign up here for thousands of more seasonal insights just waiting to be revealed!

Trade risks

Despite the strong seasonal trend and dovish Fed, European PMI data introduces significant risks. Recent reports show a steep decline in German and French PMIs, particularly in services. The French PMI fell to 47.4, while Germany’s composite PMI dipped to 47.2, suggesting a downturn in Europe’s two largest economies. These data points have raised concerns over eurozone growth and increased the probability of an ECB rate cut in October, which could temper euro gains. While the Fed’s dovish stance supports the euro, deteriorating eurozone data, particularly in PMIs, poses a downside risk. Traders should balance the current bullish seasonal trend with the potential for further eurozone economic deterioration, especially if PMI reports continue to weaken or if the ECB moves towards a rate cut.

Remember, don’t just trade it Seasonax It