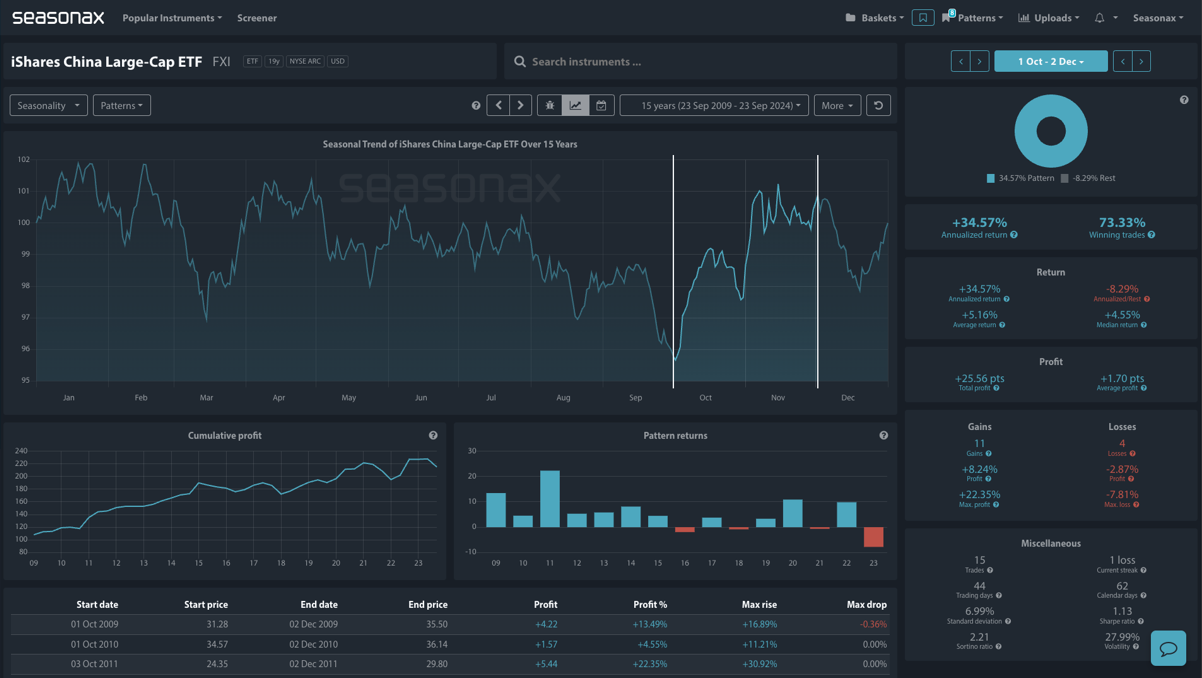

China’s recent economic stimulus measures have created optimism in the market, providing a potential tailwind for the iShares China Large-Cap ETF (FXI), which is now entering a historically strong period. The iShares China Large-Cap ETF (FXI) offers diversified exposure to the largest Chinese companies across sectors like financials, technology, and energy. From October 1 to December 2, FXI has shown a +34.57% annualized return with a 73.33% win rate over the last 15 years. This favorable seasonal trend, coupled with China’s fresh stimulus, may present an opportunity for investors.

Stimulus Measures Overview

The People’s Bank of China (PBoC) has rolled out significant measures to support economic growth:

Broad Economic Stimulus: A 20bps Reverse Repo rate cut and a 50bps reduction in the Reserve Requirement Ratio (RRR) have injected CNY 1 trillion of liquidity into the economy.

Property Sector Boost: By lowering down payments on second homes and reducing existing mortgage rates, the PBoC is addressing the struggling real estate market.

Capital Market Support: A CNY 300 billion relending facility and a CNY 500 billion stock liquidity swap facility have been introduced to support stock buybacks and market liquidity.

Market Reaction: The measures have already triggered a rally, with China’s 50 seeing a strong rally on the day of the announced support (up over 8.5% at one stage).

Technically, there is a simple way to measure risk. price is trying to break free from a key weekly trend line and as long stays above this level a re-test of 34 looks reasonable. Also, any dips back down to the 28 region marked would not be unreasonable.

Sign up here for thousands of more seasonal insights just waiting to be revealed!

Trade risks

Despite stimulus efforts, China’s economy faces significant headwinds, including slowing demand and a weak property sector. If economic data continues to disappoint, the stimulus may not be enough to support sustained growth. Furthermore, global economic conditions, particularly U.S. monetary policy and geopolitical tensions, could impact Chinese equities. Rising U.S. interest rates or trade tensions could limit the upside for Chinese stocks.

Remember, don’t just trade it – Seasonax it!