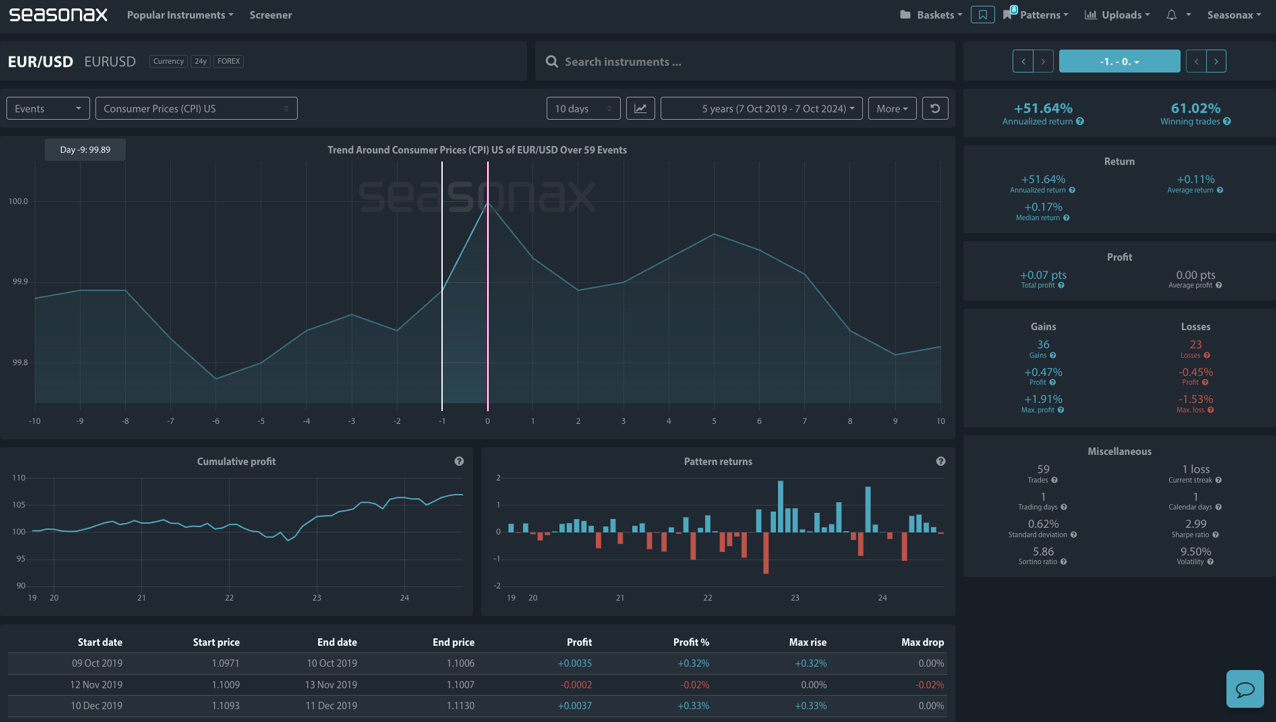

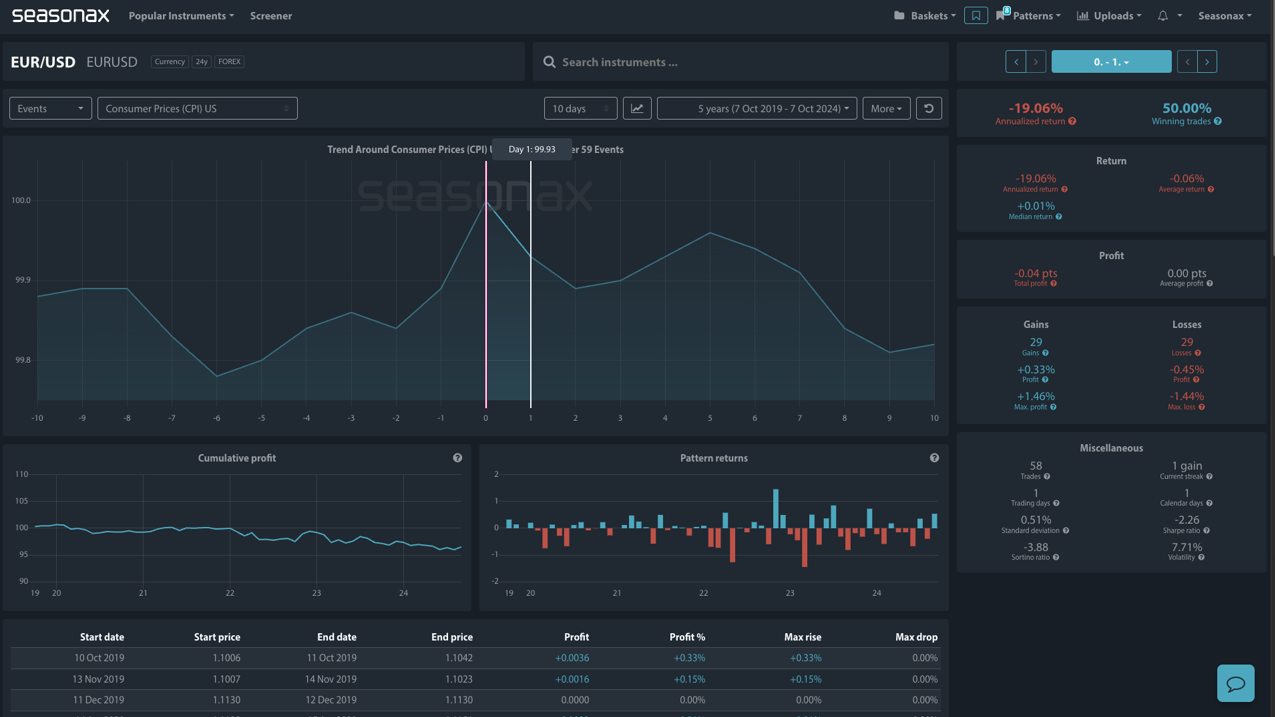

As we approach the US Core release, traders are focusing on the short-term potential for EUR/USD. Historically, the day before and after the CPI print has seen volatile movements in the pair, with the period around CPI typically exhibiting both upward and downward pressure on the EURUSD over the last 5 years.

Expectations for US CPI @13:30 UK time

Currently, markets expect US Core CPI to come in at 0.2%m/m and 3.2% y/y, in line with forecasts. The headline is expected to be 0.1% m/m and 2.3% y/y. A lower-than-expected reading would support dollar weakness, likely pushing EUR/USD higher.

Conversely, any upside surprise in inflation data could boost the dollar, increase chances of a need for a ‘higher for longer’ rate scenario and cause the EUR/USD to face downside risk.

Historically, EUR/USD tends to see some gains leading up to the U.S. CPI release. There is a 61.02% winning trade percentage and there have been gains of nearly 2% on one occasion in 2022. See data below

However, out of the event the EURUSD has historically experienced weakness over the last 5 years, which in part makes sense due to the high inflation readings we have had post Covid-19.

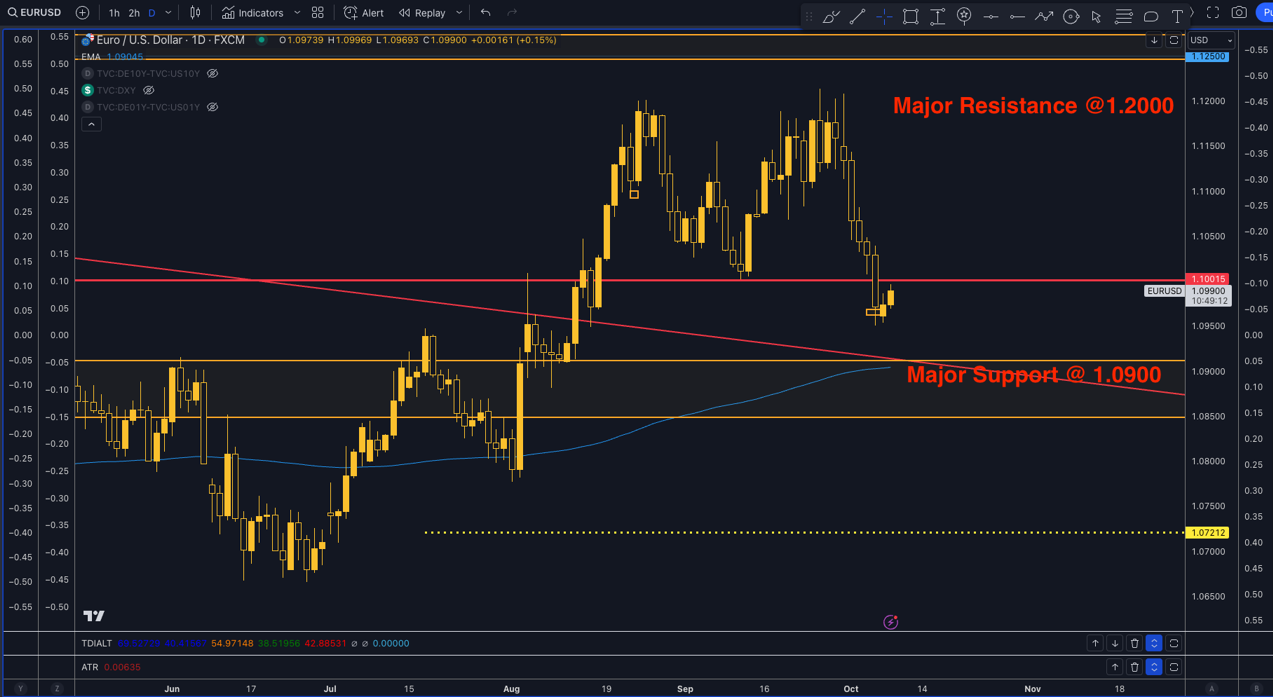

Technically, major support sits at 1.0900 on the EURUSD to the downside and 1.1200 to the upside which provides some large target areas for large, out of consensus prints.

Traders should be prepared for EUR/USD volatility around the upcoming CPI release. While historical trends show a general bullish bias for the euro in the day before the print, a higher-than-expected CPI figure could lead to dollar strength and pressure the euro lower, making it critical to monitor the actual CPI data against forecasts.

Sign up here for thousands of more seasonal insights just waiting to be revealed!

Trade risks

The major risk here is based on the US CPI print with am out of consensus print most likely to move markets.

Don’t just trade it—Seasonax it!