Novo Nordisk is positioning its new obesity drug, CagriSema, to potentially lead to at least 25% weight loss in patients, setting a new benchmark in the competitive weight-loss drug market. This combination of semaglutide, which mimics the GLP-1 hormone, and cagrilintide, which targets another hormone, amylin, aims to provide enhanced efficacy without increased side effects. The company hopes to differentiate itself as it faces strong competition from Eli Lilly’s Zepbound, which has already demonstrated greater weight loss, and other upcoming therapies that may offer simpler dosing options.

As Novo prepares for critical clinical trial results due in December, the pressure is mounting, particularly after a 25% drop in stock value linked to lower-than-expected prescriptions for Wegovy and investor concerns (see chart below for drop marked). Analysts warn that while success with CagriSema could solidify Novo’s position, failure might lead to significant losses. According to Bloomberg, with earnings set to be announced on November 6, analysts suggest that a positive outcome might only provide a slight boost to the company’s value, while a disappointing result could result in a 10% decline.

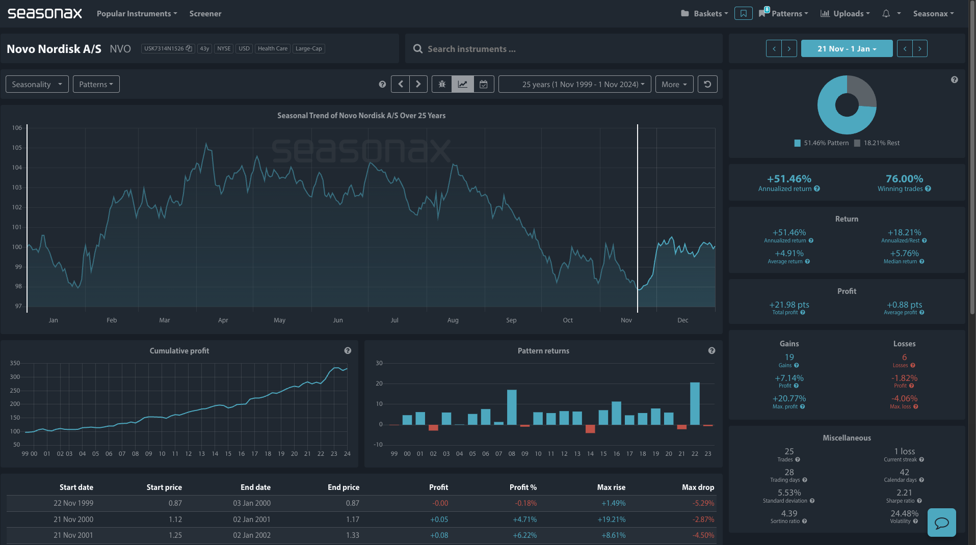

Seasonal data indicates that weight-loss drug usage typically sees spikes during the New Year and summer months, suggesting that Novo’s timing for CagriSema could be critical. Seasonally, Novo Nordisk has a strong period from November 21 through two January 1 with gains over 75% of the time and an average return of 4.91%. The annualised return is over 50% and the maximum gain has also been a super strong +20%. So, could a potential earnings induced drop lead to a dip buying opportunity?

Technically, price has fallen to the 200EMA on the weekly chart (blue line) and that can offer a decent support level for prices should earnings reassure investors on November 06.

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade risks

While the seasonal outlook is favourable, risks remain. The weight loss drug market is highly competitive, lucrative, and innovative. This means price direction is likely to be both volatile and uncertain.

Don’t Just Trade It – Seasonax It!