German Chancellor Olaf Scholz’s coalition fractured after firing Finance Minister Christian Lindner, sparking an agreement for early German elections now set for February 23. Scholz will face a confidence vote on December 16, leading to the election if he loses. The opposition’s conservative CDU/CSU, led by Friedrich Merz, is currently polling ahead, while support for Scholz’s SPD has declined. Economic challenges—including a struggling manufacturing sector and weak investor confidence—add urgency, as business leaders call for stability amidst global uncertainty and potential U.S. trade tensions.

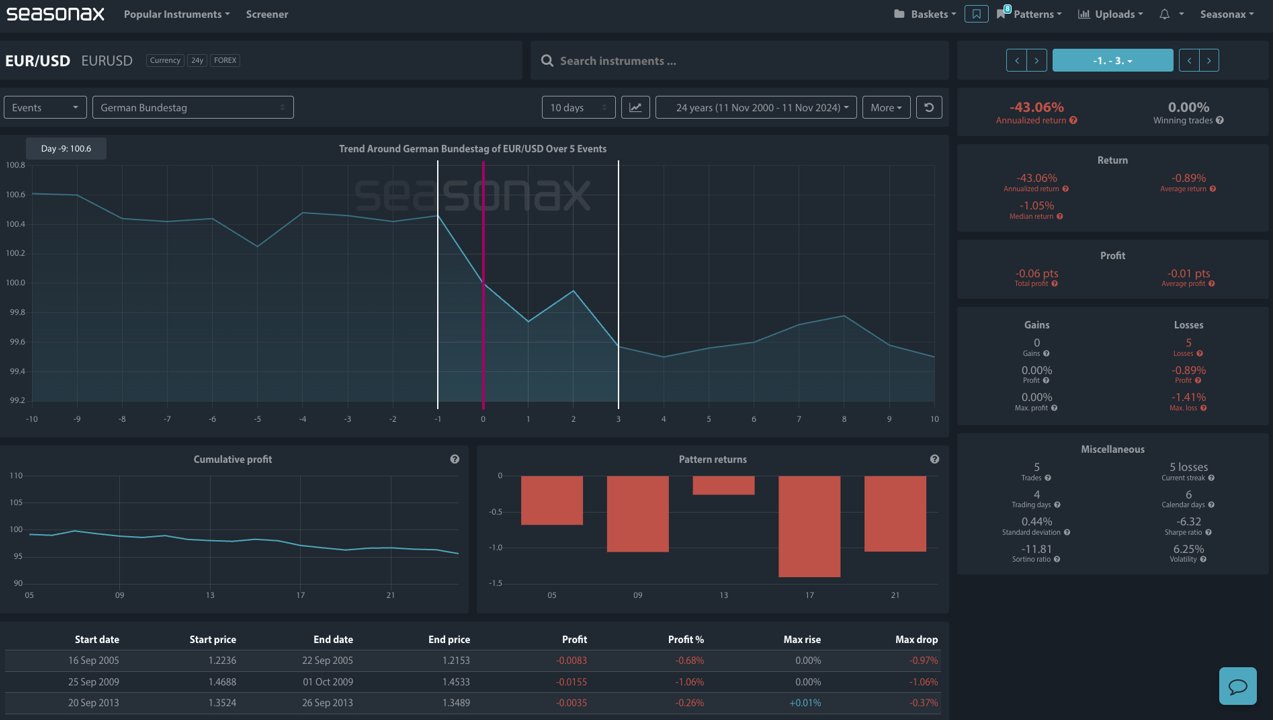

Using Seasonax’s event feature shows us the impact of the EURUSD over the 5 German elections. Every one of them has resulted in further EUR downside. Seasonal analysis of the EUR/USD pair around the German Bundestag event using historical data from Seasonax. The trend shows a consistent decline in EUR/USD, with the annualized return down -43.06%, and all five historical occurrences resulting in losses. Average return per event is -0.89%, with a maximum drawdown of -1.41%. The data suggest a bearish pattern for EUR/USD around this event, reflecting weak gains, high volatility, and no winning trades in the sample.

Technically, there is a major support area marked around 1.0500. This will provide a natural target and turn around level for the EURUSD, so if the chances of a German snap election fade there could be a short relief rally in the pair.

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade risks

The main risk is from other geopolitical issues that can also influence the EURUSD pair – mainly those from the US.

Don’t Just Trade It – Seasonax It!