The Santa Rally, a period of strong stock market performance in the last part of December. It exists due to a combination of psychological, market, and technical factors. Investor optimism during the holiday season, combined with the conclusion of tax-loss harvesting and fund managers’ year-end “window dressing,” often boosts buying activity. Low trading volumes during this period can amplify price movements, while year-end bonuses and positioning for the new year further contribute to upward momentum. Additionally, the self-fulfilling nature of the phenomenon, where investors buy in anticipation of the rally, reinforces its existence. Together, these elements create a favourable seasonal trend in the S&P 500, though its strength can vary depending on broader market conditions.

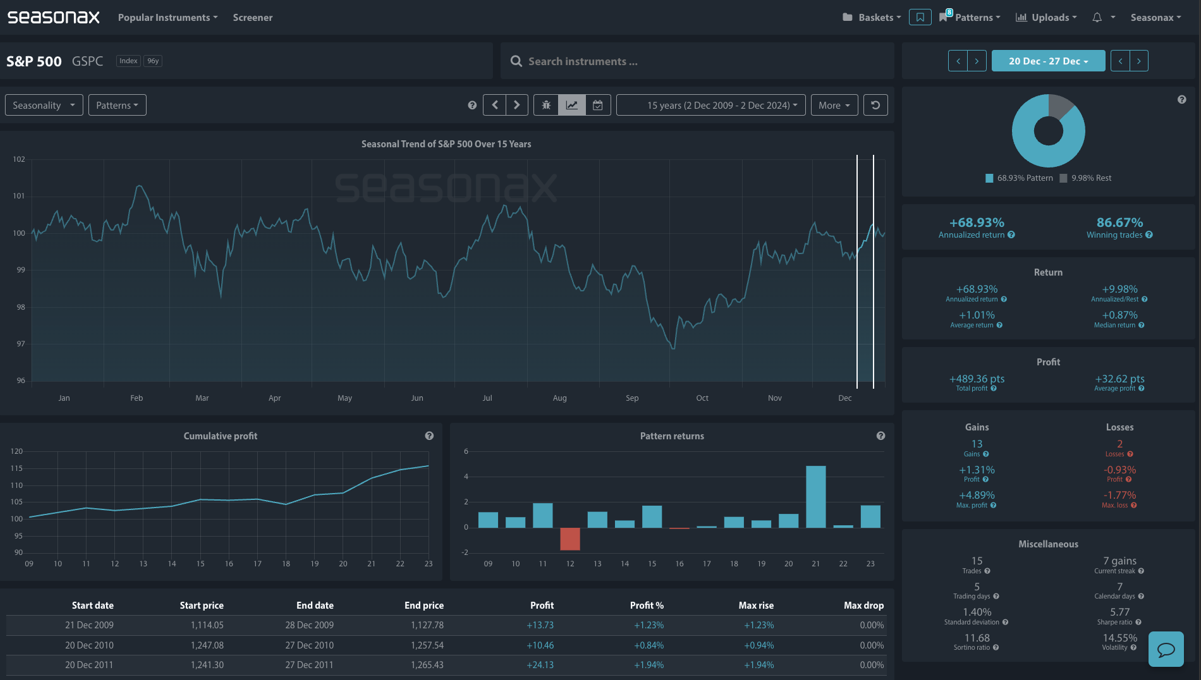

The S&P 500 shows a historically strong seasonal pattern from December 20 to December 27, delivering an annualized return of +68.93% over the past 15 years with a high win rate of 86.67%. The average return during this period is +1.01%, supported by low volatility (1.40% standard deviation) and a consistent seven-year streak of gains. This performance aligns with the broader Santa Rally phenomenon, driven by year-end portfolio adjustments, reduced tax-loss selling, and holiday optimism. With a maximum single-period gain of +4.89% and a relatively mild drawdown of -1.77%, the trend suggests a favourable short-term risk-reward dynamic for traders. However, while historical data points to consistent profitability, external market factors could still influence outcomes.

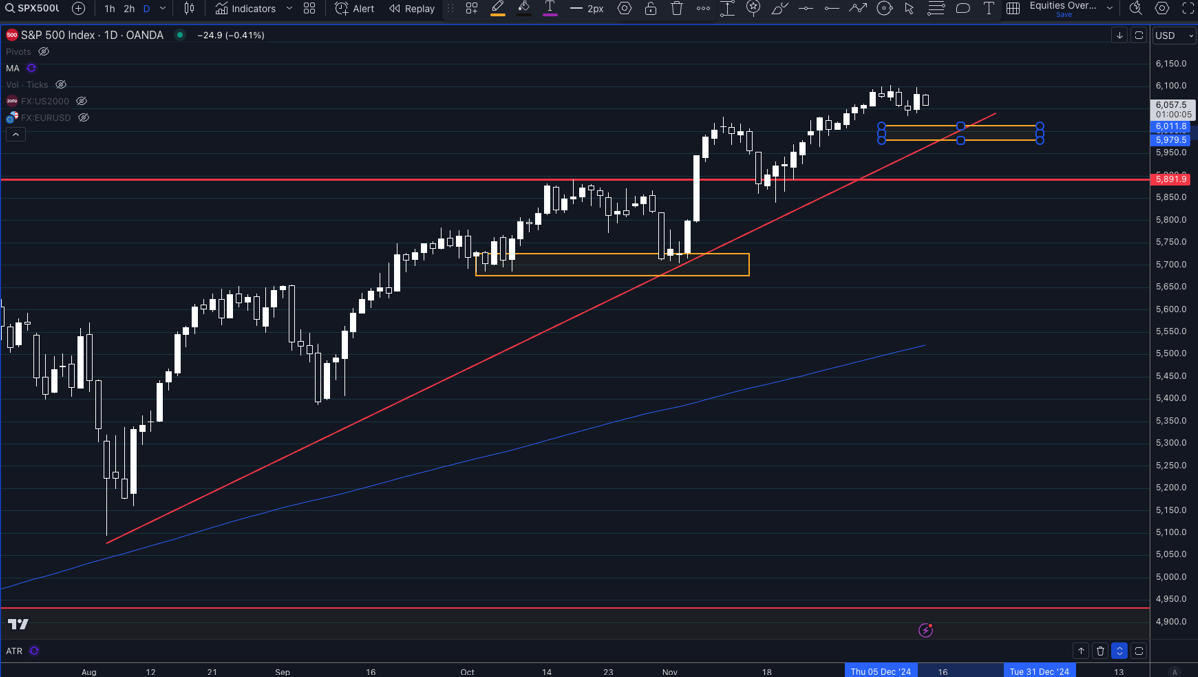

Technically, there is a very strong support level at 6,000 marked on the chart below as a decent area for potential entries/stop placements.

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade risks

While historical data points to consistent profitability, external market factors could still influence outcomes.

Don’t Just Trade It – Seasonax It!