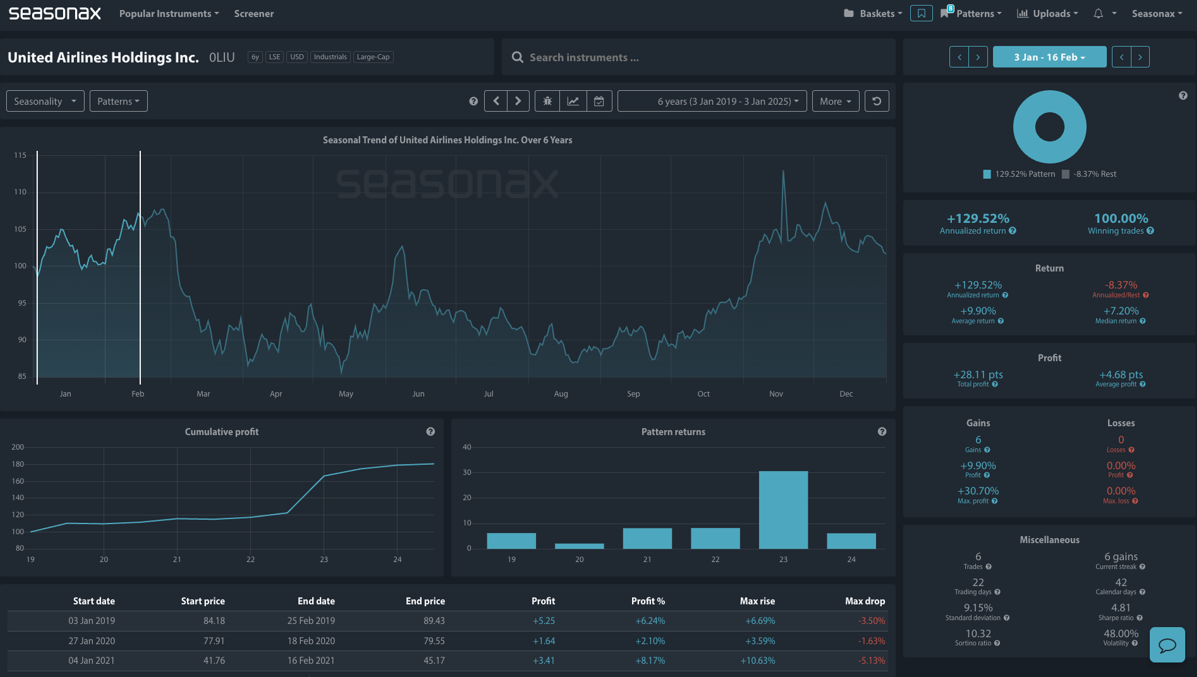

Instrument: United Airlines Holdings Inc. (UAL)

Average Pattern Move: +9.90%

Timeframe: Jan 03 – Feb 16

Winning Percentage: 100%

United Airlines Holdings Inc. has announced plans to begin deploying SpaceX’s Starlink for inflight Wi-Fi as early as spring. This marks United as the first major U.S. carrier to adopt Elon Musk’s satellite-powered internet service, potentially reshaping the airline’s competitive landscape and passenger experience.

The rollout will initially target the regional Embraer SA E175 jets, with the entire two-class fleet expected to be Starlink-enabled by the end of this year. A broader implementation across United’s mainline jets is anticipated before the end of 2025. However, the airline has adjusted its strategy, limiting free access to members of its loyalty program, MileagePlus, instead of offering it to all passengers for free as originally planned. This strategic move could incentivize customer loyalty while leveraging Starlink’s cutting-edge technology to enhance inflight connectivity. The result could be greater appeal to tech-savvy travelers and corporate clientele who demand reliable internet for work or entertainment.

Based on historical analysis, United Airlines’ stock has demonstrated exceptional performance from January 3 to February 16 although the pattern has only been over the past six years . During this period it has seen an Annualized Return of +129.52 and winning trades with a 100% success rate (6 out of 6 trades). The average return has been +9.90%The seasonal trend indicates consistent gains, highlighted by a strong cumulative profit curve.

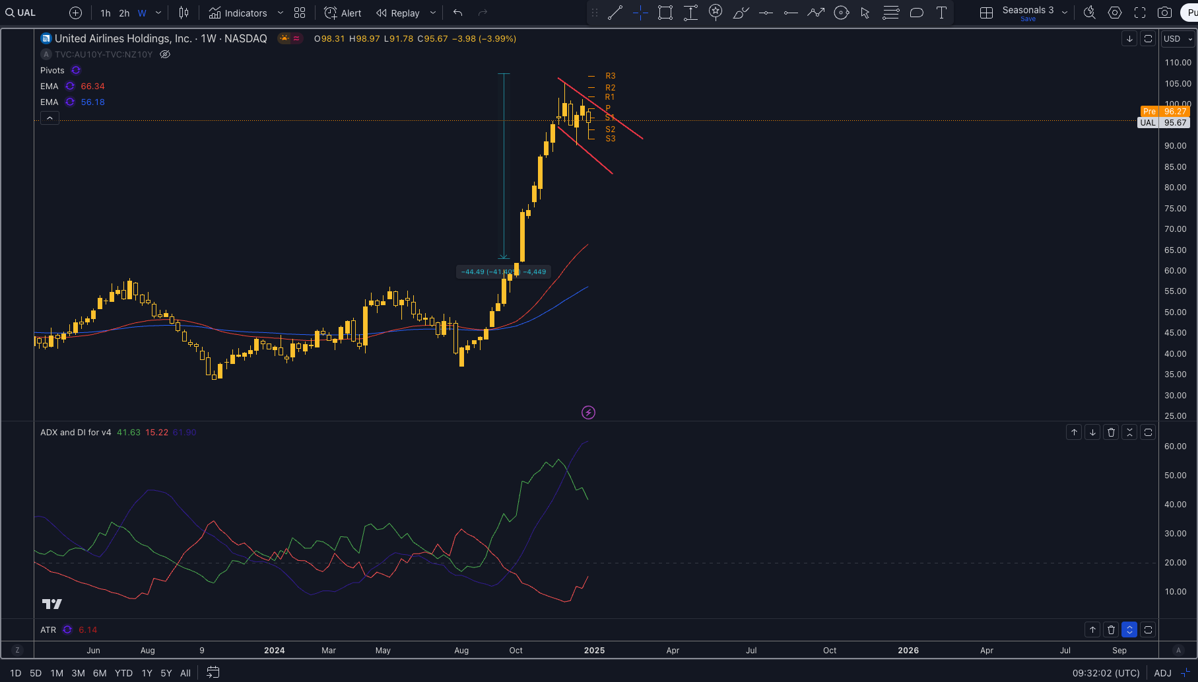

Technical Signals

The technical landscape also supports a positive bias. Recent patterns suggest United Airlines is benefiting from a stable trend, while broader market sentiment for travel stocks aligns with this seasonal bullishness. There is a strong bullish trend in place on the weekly chart and traders can look for bullish flag patterns for potential opportunities to join any potential uptrend.

Will Starlink Propel United Airlines?

United’s seasonal stock performance provides a promising backdrop, making this an intriguing period for traders to watch. Will the airline’s bold move pay off in the form of higher passenger satisfaction and a corresponding rise in share value? Only time will tell.

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade risks

While Starlink offers promising technological advantages, several risks could impact United’s ability to leverage the partnership effectively. Pricing Uncertainty: non-loyalty members’ pricing remains undisclosed, which could influence passenger adoption rates. Implementation challenges: Ensuring a seamless rollout across a large fleet may face delays or technical hurdles. Finally, market competition as rival airlines adopting similar services could dilute the competitive edge.

Don’t Just Trade It – Seasonax It!