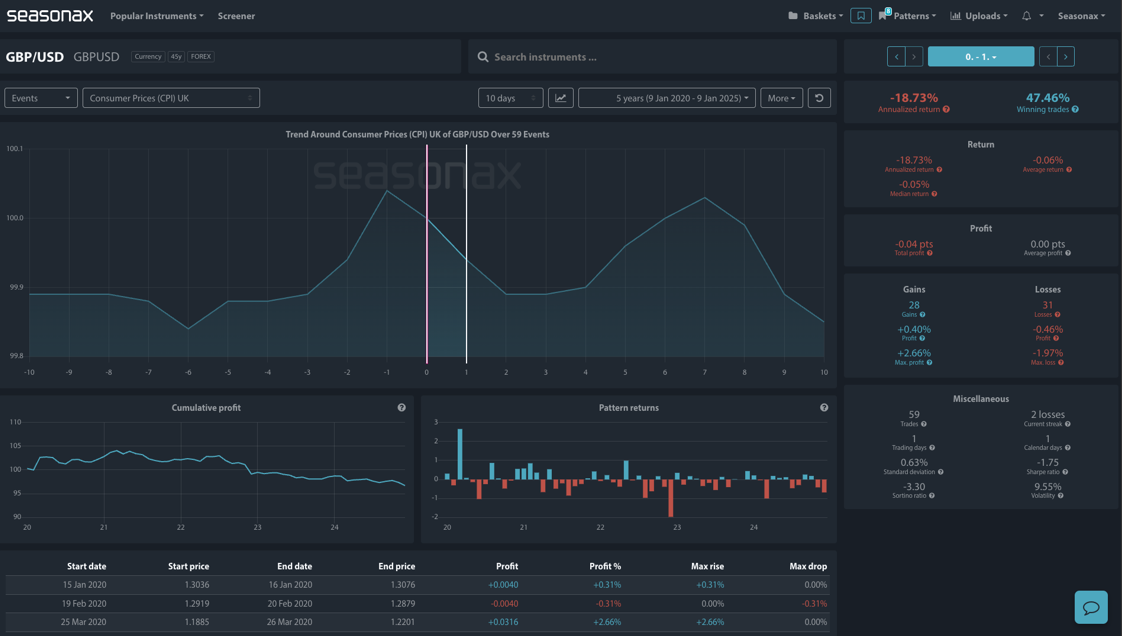

Instrument: GBPUSD

Maximum fall: -1.97%

Timeframe: The day of UK CPI

Winning Percentage: 47.46%

The Importance of This Week’s UK CPI Print

The upcoming UK Consumer Price Index (CPI) report is set to play a pivotal role in shaping market expectations around the Bank of England’s (BoE) monetary policy trajectory. With the BoE’s inflation outlook already under scrutiny, this release will offer critical insights into the persistence of inflationary pressures, particularly in the services sector, which has been a focal point for policymakers due to its strong link to domestic wage growth. UK services inflation was 5% y/y for November and that is incompatible with the BoE’s 2% target.

BoE’s Concerns: Services Sector Wage Growth

The BoE has repeatedly flagged the services sector as a major contributor to the stickiness in inflation. Wage growth in this sector has remained robust, sustaining upward pressure on core inflation metrics. The persistence of elevated services inflation has complicated the BoE’s ability to decisively pivot toward a more dovish policy stance.

Potential for GBP Weakness

A softer-than-expected CPI print next week could serve as a catalyst for further GBP depreciation. A downside miss in inflation would likely increase market expectations for rate cuts beyond the 50bps currently priced in, weakening the relative attractiveness of the GBP even further. Lower inflation expectations would also reduce the real yield advantage of UK assets, further pressuring GBP. Looking at Seasonax’s event feature for the UK CPI print shows some useful data. The biggest drop in the GBPUSD over the last 5 years for the UK CPI report has been -1.97% on December 14th 2022. There have been falls of 1% or more on two other occasions. So, if we do see an out of consensus print to the downside it would not be unreasonable to see the GBPUSD fall around 1%. This can help in terms of reasonable intraday profit targets.

Technically, the GBPUSD is struggling after last week’s UK gilt wobble and 1.2100 sits below as major support (marked below) and as a key target for any further GBP selling. Remember too that the GBPUSD drop has also been on tariff concerns boosting the USD ahead of President-elect Trump’s second term as US President.

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade risks

The main risk is that UK CPI surprises to the upside and that could send the GBP higher.

Don’t Just Trade It – Seasonax It!