Instrument: DXY

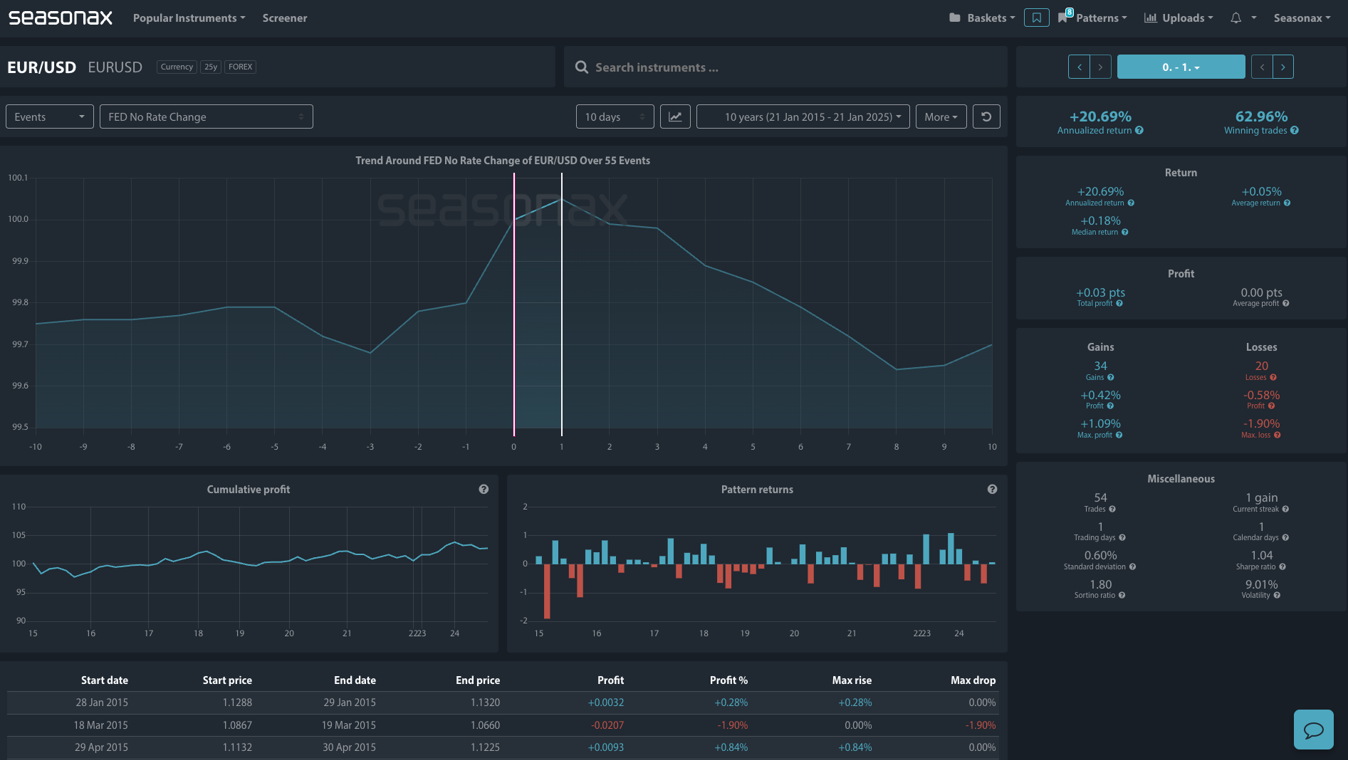

Maximum Pattern Move: +1.09%

Timeframe: Day of the Fed meeting

Winning Percentage: 62.96%

Seasonal Risk Event Strength

The seasonal risk event analysis of the EURUSD over the Fed’s historical interest rate decisions is a very useful tool that Seasonax provides. In fact, you can narrow down the data even further to look at how various instruments react when the Fed announce ‘no change’ to their policy rate. For the Fed’s meeting on Jan 29th the expectation from analysts and STIR markets is that the Fed will keep rates steady at 4.375% with it being seen as a 100% chance of an ‘on hold’ decision. Interestingly, we can see that over the last 10 years when the Fed has kept rates on hold the EURUSD has tended to upside gains with a 62.96% win percentage and the maximum gain being over 1%. The use of this tool is that it can help you establish historical maximum and minimum moves over the event. So, if there is a reason to trade, Seasonax’s data shows you what to expect in terms of how far the EURUSD has gone historically. Now, we know that history does not necessarily repeat itself, but it does often rhyme!

Technical Perspective

A look at the EURUSD on the daily chart shows that the 1.0450 is a key support area and 1.0600 a key resistance area overhead.

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade risks

The outlook for the EURUSD will largely depend on direction given by Powell in his post rate decision press conference as to what the Fed think about the upcoming path of rates for the Fed for this year.

Don’t Just Trade It – Seasonax It!