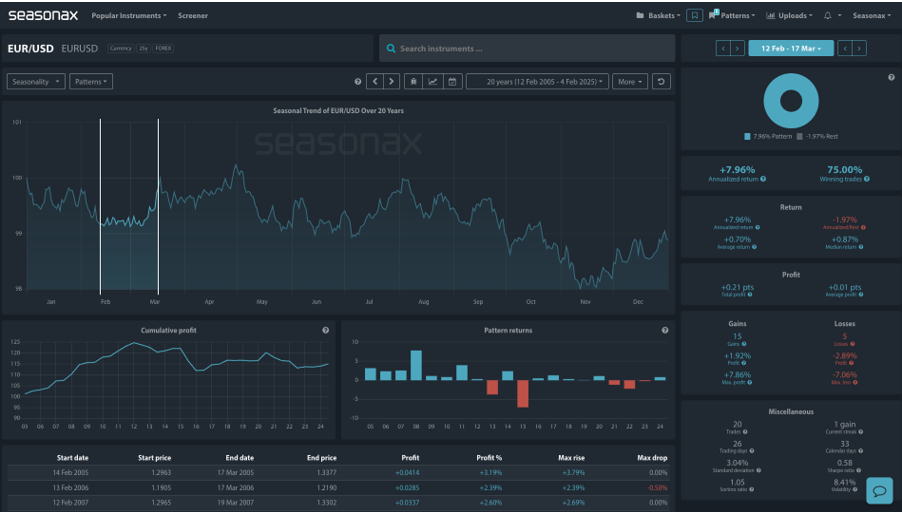

- Instrument: EURUSD

- Average Pattern Move: +0.70%

- Timeframe: February 12 – March 17

- Winning Percentage: 75%

Market Analysis and Drivers

As the Eurozone navigates economic uncertainty, traders are watching closely for signs of EUR/USD strength. With the Federal Reserve pivoting towards rate cuts later this year and European Central Bank (ECB) policy expectations in flux, the next few weeks could be pivotal for the currency pair.

So far, Fed officials remain cautious, pushing back against aggressive rate-cut expectations, but softer U.S. inflation prints or weaker economic data could tilt sentiment in favour of the euro. US CPI is out this week. Meanwhile, the ECB remains in a holding pattern, waiting for further inflation data before committing to easing.

Will these shifting macro forces align with EUR/USD’s historical seasonal strength between February 12 and March 17?

Seasonal Data Analysis

History suggests that EUR/USD tends to rally in mid-Q1, delivering a +7.96% annualized return between February 12 and March 17 over the past 20 years. The pair has gained in 75% of occurrences, with an average return of +0.70% and a median return of +0.87%. The maximum recorded gain during this period was +7.86%, while the worst decline reached -7.06%. The cumulative profit chart highlights a steady rise in EUR/USD, with strength particularly notable around early March. Given this backdrop, could a shift in Fed or ECB rhetoric help EUR/USD extend gains in line with this seasonal pattern?

With historical data favouring a February–March EUR/USD rally, traders should watch closely for fundamental catalysts that could fuel the move. If U.S. economic data softens and rate expectations shift, the euro could see renewed demand. However, stronger U.S. growth and sticky inflation remain risks to this setup.

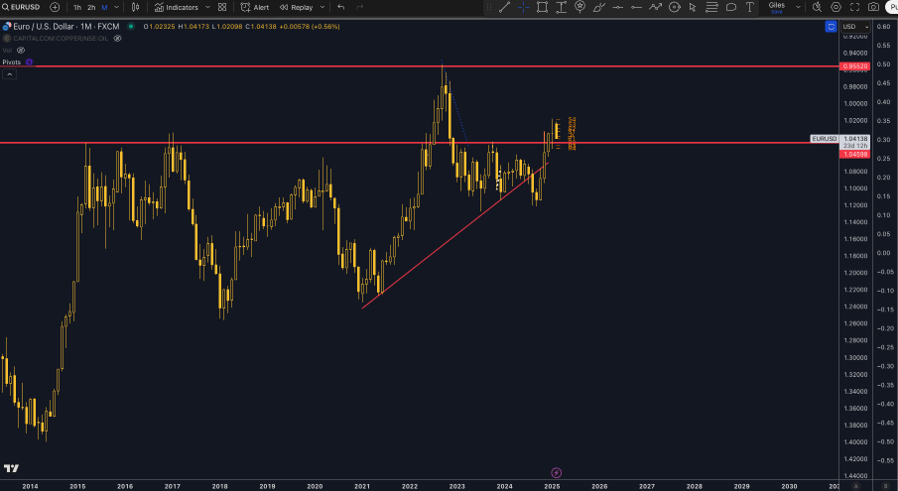

Technical Perspective

From a technical standpoint the EURUSD has some major monthly support and resistance with parity at 1.0000 a major big round number overhead.

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade risks

Geopolitical tensions and policy changes could impact this outlook and stronger U.S. growth and sticky inflation remain risks to this setup.

Don’t Just Trade It – Seasonax It!