- Instrument: Adidas

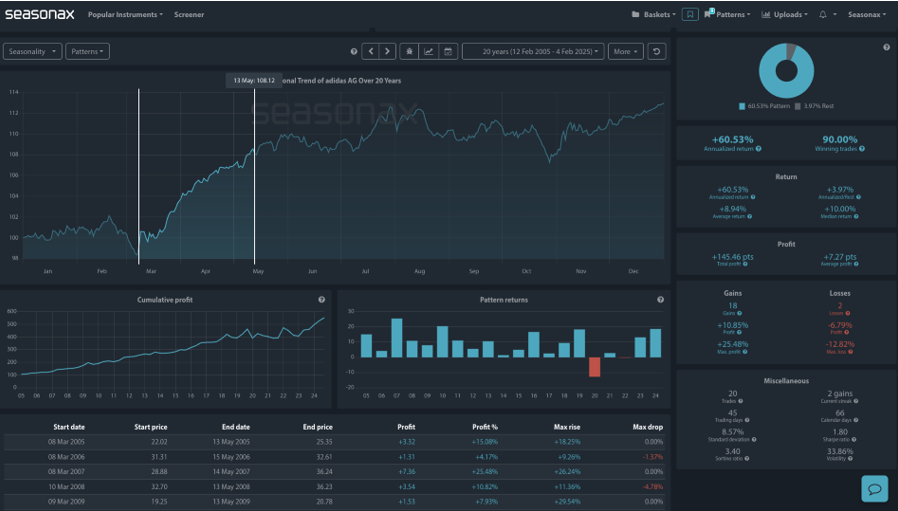

- Average Pattern Move: +9.55%

- Timeframe: March 08 – May 15

- Winning Percentage: 90%

Seasonal dip ahead?

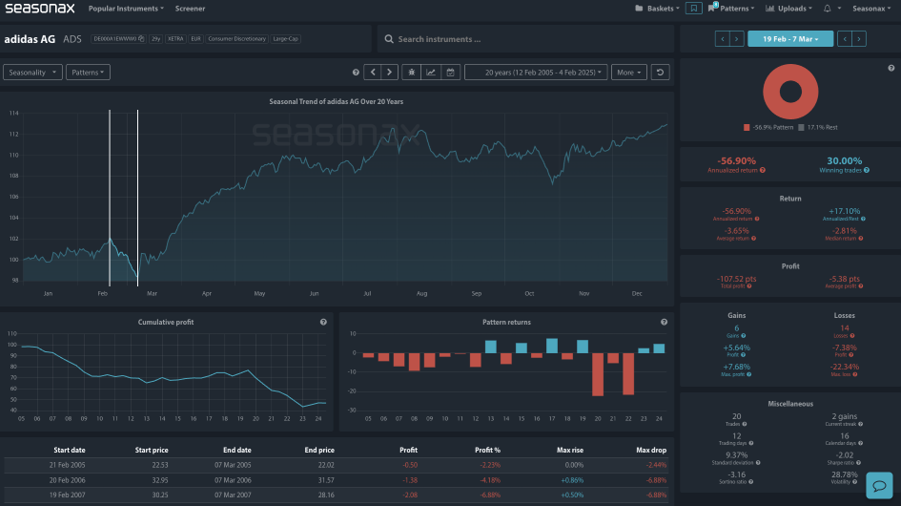

Adidas has been a key beneficiary of the sportswear boom, but seasonality suggests that investors might be in for a near-term dip before a stronger rebound. The data highlights a notable period of weakness from February 19 to March 7, where Adidas has posted a negative annualized return of -56.90%, with only 30% of occurrences ending in gains. This suggests that short-term downside risk is elevated, potentially driven by broader market corrections, consumer sentiment shifts, or sector-specific factors.

However, this dip could set up a high-probability buying opportunity, as the stock historically rebounds strongly from March 8 through mid-May, boasting a +60.53% annualized return and a 90% win rate. Investors should be watching for signs of bottoming, as past patterns indicate that once the seasonal weakness subsides, Adidas tends to rally significantly.

Technical Perspective

From a technical standpoint, major support for Adidas sits at the 225 and 235 region where the 100 and 200EMA sit. Could any dips there provide buying opportunities? The Adidas seasonal playbook suggests that patience may be rewarded—while near-term weakness could test investor confidence, history shows that mid-March typically marks the turning point for a strong rally. With a 90% win rate in the post-dip period. Will these seasonals play out again this year?

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade risks

The key risk to this setup is that if broader market conditions deteriorate or consumer demand weakens, Adidas may extend losses beyond the typical seasonal dip, delaying the expected rebound. Additionally, if macro factors such as weaker earnings, supply chain disruptions, or unexpected industry headwinds emerge, the stock could struggle to regain upside momentum, breaking from its historical pattern.

Don’t Just Trade It – Seasonax It!