- Instrument: Unilever

- Average Pattern Move: +6.12

- Timeframe: February 18-May 15

- Winning Percentage: 85%

Market Analysis and Drivers

Unilever is in the midst of a corporate shakeup after unveiling a cost-cutting strategy last year that will see 7,500 jobs eliminated globally. At the same time, the company is rumored to be eyeing Vitabiotics Ltd., a UK-based vitamin company, as part of a strategic move to expand its health and wellness portfolio.

The London-based Vitabiotics, led by former Dragons’ Den investor Tej Lalvani, is reportedly preparing for a £1 billion sale, attracting interest from Unilever, Nestlé, and private equity firms. If Unilever secures the acquisition, it would reinforce its footprint in the fast-growing health supplements market, potentially boosting long-term revenue.

With corporate restructuring and M&A activity in focus, could Unilever’s historical seasonal strength help guide investors through the volatility?

Seasonal Data Analysis

Unilever enters one of its strongest seasonal windows from February 18 to May 15, boasting an 85% win rate over the past 20 years and an annualized return of +28.66%, with an average gain of +6.12%. The maximum recorded gain during this period reached +16.87%, reinforcing a historically strong bullish trend. The cumulative profit trend highlights a steady and consistent uptrend, suggesting that Unilever’s stock typically experiences positive momentum through Q2. With corporate restructuring and acquisition rumors fueling speculation, this seasonality could serve as a valuable guide for positioning in the stock.

Technical Perspective

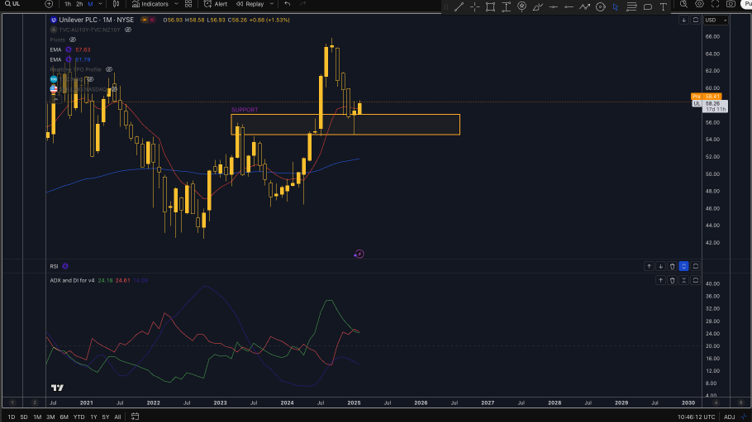

From a technical standpoint, Unilever has been finding support around the 56 level where the 100EMA (red line) sits and strong horizontal support from June 2023. This will be a major level that will need to hold for more upside in the near term.

Trade risks

The primary risk to this setup is that if cost-cutting efforts fail to drive efficiency, or if the Vitabiotics acquisition does not materialize, sentiment could weaken. Additionally, broader market weakness or a slowdown in consumer spending could disrupt Unilever’s historical seasonal trend.

Sign up here for thousands more seasonal insights waiting to be revealed!

Remember, Don’t Just Trade It – Seasonax It!