- Instrument: S&P 500 (GSPC)

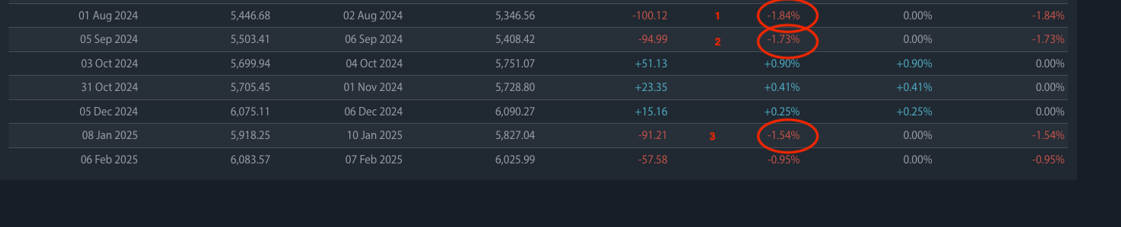

- Average Pattern Move: +0.17% Median return

- Timeframe: 10 days post-NFP

- Winning Percentage: 55.00%

You may not realize how crucial the upcoming Non-Farm Payrolls (NFP) release is for shaping rate expectations and equity market trends. With Federal Reserve Chair Jerome Powell reinforcing a “wait-and-see” stance on monetary policy, labor market resilience will be a key driver of market sentiment. Historically, the S&P 500 has demonstrated a +31.31% annualized return around NFP releases, with a tendency to grind higher after the data. Given Powell’s latest remarks on labor conditions, we want to analyze the data in more detail.

Powell’s Policy Bias and the Labor Market Outlook

At the Fed’s February meeting, Powell signaled that the central bank is in no rush to cut rates, emphasizing that policy will remain tight unless inflation moves decisively toward 2%. The labor market remains solid, with a steady unemployment rate, supporting the Fed’s cautious approach. However, Powell also acknowledged that a weaker-than-expected jobs report or a sudden rise in unemployment could justify easing sooner than markets anticipate.

This sets the stage for a pivotal NFP print—a strong jobs number could further delay rate cut expectations, while a weak reading may revive speculation of easing, boosting equities in line with historical post-NFP trends.

What Does Seasonality Suggest?

The chart shows the typical development of the S&P 500’s price action around NFP reports over the past five years. Historically, the index has exhibited a gradual upside bias post-NFP, with a +0.17% average return in the subsequent trading sessions. Although market reaction depends on the data itself, past trends indicate that equities tend to absorb NFP volatility and move higher, particularly if rate expectations remain stable.

Also, the last 7 prints have shown three occasions where the S&P500 has moved lower by more than 1.50%. So, a big miss to the downside could open up a 1.5% fall.

Technical Perspective

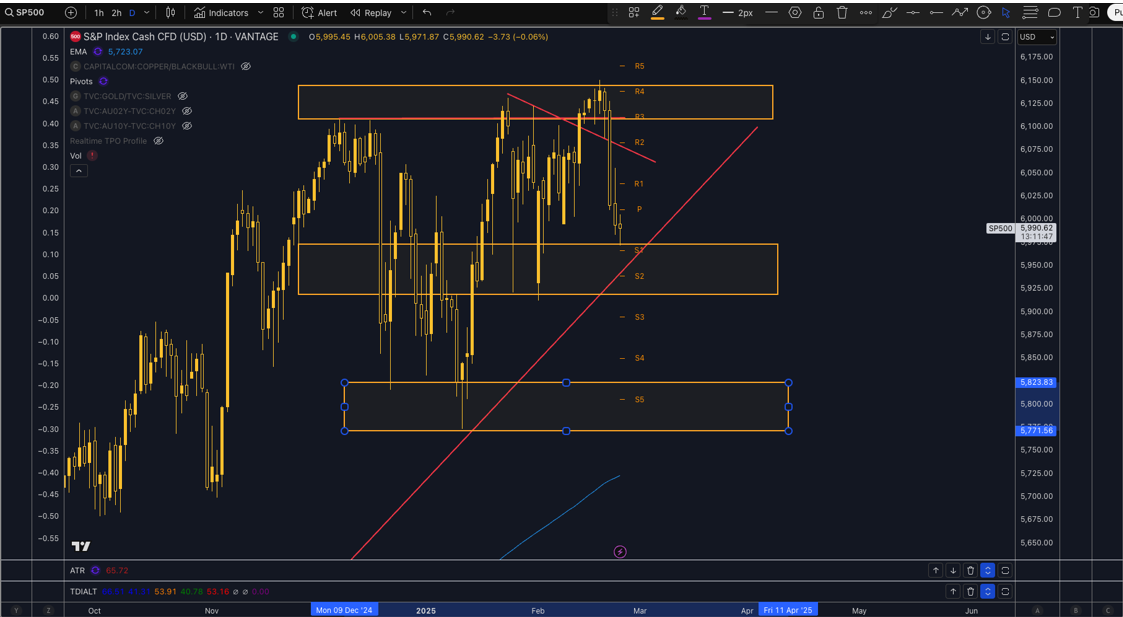

From a technical standpoint there are three very strong levels to note – the 6100 level, the 5950 level and the 5800 level. Expect these to act as strong support/resistance zones with any clean decisive breaks being important.

Use Seasonax for your professional handling of market-moving events!

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade risks

The moves in the S&P500 will very much depend on the details of the print, so there is strong event risk with this outlook and many investors prefer to avoid trading around highly volatile events like the NFP

Don’t Just Trade It – Seasonax It!