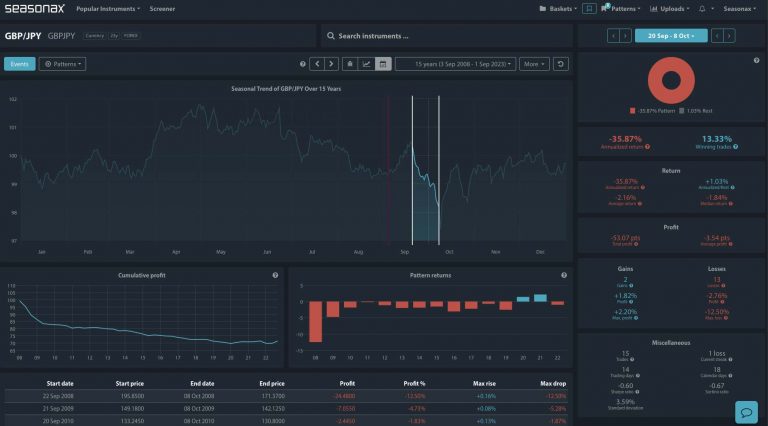

Instrument: USD/JPY

Average Pattern Move: -0.07%

Timeframe: 1 day post-Fed meeting

Winning Percentage: 48.75%

Dear Investor,

You may not realize it, but the upcoming Federal Reserve meeting could have significant implications for USD/JPY, particularly given the ongoing debate around monetary policy and the strength of the U.S. economy. As recession risks remain low relative to hard data but political noise distorts soft data, markets are grappling with how the Fed will interpret recent trends. With U.S. growth expectations recalibrating we want to analyze the data in more detail.

USD/JPY and the Fed Meeting: A Bearish Seasonal Bias

Historically, USD/JPY has shown a negative bias in the immediate aftermath of Fed meetings, with an annualized return of -32.02% on the day following the event. The win rate sits at 48.75%, indicating that while direction is uncertain, downside risks have prevailed in past Fed decision weeks with the average return -0.11%. This suggests that should the Fed deliver a message that reinforces a dovish path, USD/JPY could weaken further.

The chart above highlights USD/JPY’s typical trend around FOMC meetings, showing a pattern of initial strength followed by a sharp drop in the subsequent trading sessions. This aligns with the risk that any perceived shift toward more rate cuts could put pressure on the dollar.

Fundamental Analysis: How Will the Fed React?

At the start of 2025, optimism dominated the economic outlook, but recent developments have tempered expectations. The initial belief was that President Trump’s policies would turbocharge growth through tax cuts and deregulation. However, his focus on government spending cuts and aggressive tariff policies has instead heightened concerns over employment and corporate profit margins.

Markets had previously priced in only one 25bps rate cut for 2025, but sentiment has since shifted. A combination of weaker business sentiment, rising input costs due to tariffs, and an increasingly cautious Federal Reserve has fueled expectations of at least two, possibly three, rate cuts this year.

Fed Chair Jerome Powell’s most recent comments suggest that while growth is slowing, labor markets remain strong, and inflation remains above target. This gives the Fed little reason to aggressively cut rates in the near term, reinforcing the likelihood that the central bank will stick to its base case of two cuts this year while leaving room for adjustments should economic conditions deteriorate further.

One key element to watch will be the Fed’s updated GDP projections. If Powell downplays recession risks and signals confidence in the economy, markets may be forced to unwind excessive rate cut bets, providing some temporary support for the U.S. dollar. However, if concerns over trade disruptions and slowing global demand grow, USD/JPY could come under renewed selling pressure.

Trade Risks

The outcome for USD/JPY will be highly dependent on the Fed’s tone and forward guidance. A hawkish surprise, such as retaining only one cut in its projections, could spark short-term USD strength, while a more dovish pivot could send USD/JPY lower in line with the seasonal pattern. Additionally, market reaction to Powell’s comments on inflation, QT, and global trade risks will be crucial in shaping the next move in the currency pair.

Will this Fed meeting reinforce the bearish USD/JPY seasonal trend, or will policymakers push back on rate cut expectations? Use Seasonax for your professional handling of market-moving events!

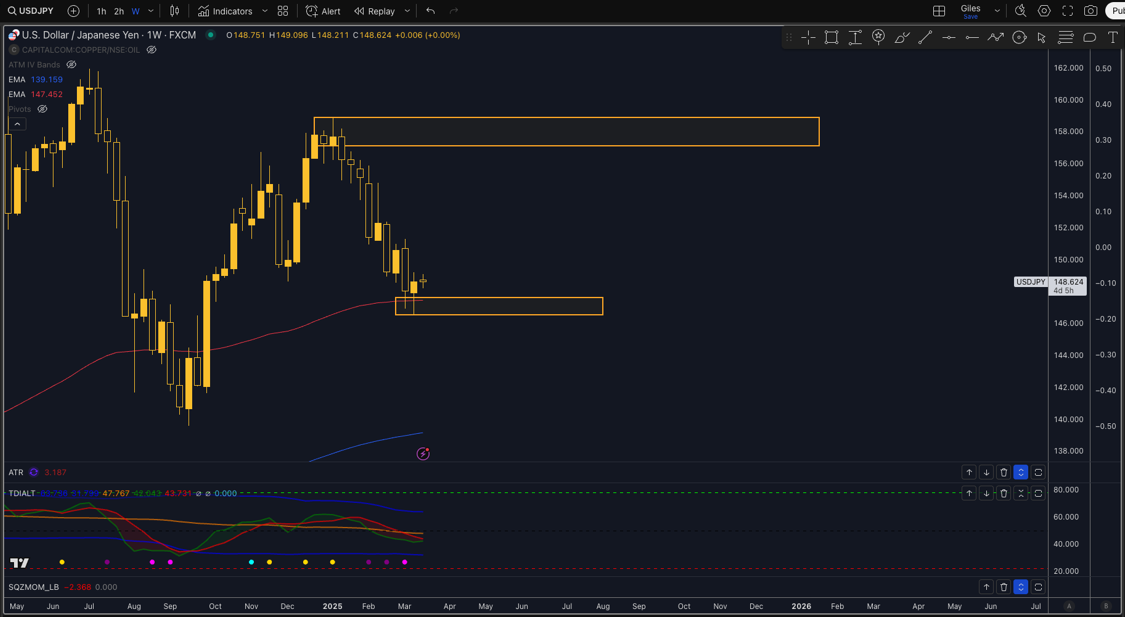

Technical Perspective

From a technical standpoint there is a major weekly support level at 147.50 which is on the weekly 100 EMA and key support. This is a clear area for buyers or seller to lean against in the event of a surprise from the Fed on Wednesday.

Use Seasonax for your professional handling of market-moving events!

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade risks

The outcome for USD/JPY will be highly dependent on the Fed’s tone and forward guidance. A hawkish surprise could spark short-term USD strength, while a more dovish pivot could send USD/JPY lower in line with the seasonal bias. Additionally, market reaction to Powell’s comments on inflation, QT, and global trade risks will be crucial in shaping the next move in the currency pair.

Don’t Just Trade It – Seasonax It!