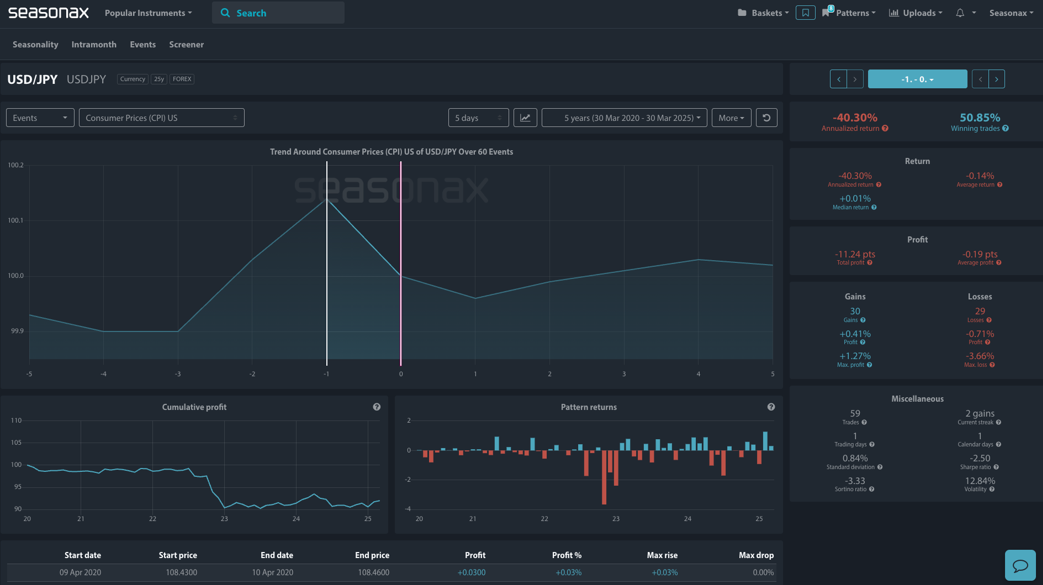

- Instrument: USD/JPY

- Average Pattern Move: -0.14%

- Timeframe: CPI Day

- Winning Percentage: 50.85%

Dear Investor,

You may not realise how USD/JPY has shown greater moves to the downside post-CPI softness, especially when inflation surprises on the low side. With the next US CPI release due on April 10 at 13:30 BST, traders are once again preparing for potential volatility. We want to analyse the data in more detail.

The chart below shows you the typical development of the USD/JPY exchange rate over the five-day window around US CPI releases across the last 60 comparable events. The pattern shows a bias towards a clear drop on the day of the CPI release, with a cumulative average return of -0.14% on the US CPI day. That translates to an annualised return of -40.30%, with losses occurring in just under half the cases.

This weak post-CPI trend reflects how sensitive USD/JPY is to disinflationary outcomes. When CPI surprises lower, US10 yields fall, and the yen tends to strengthen as traders anticipate a more dovish Fed.

Why It Matters Now

The prior CPI print came in at 2.8% y/y and 0.2% m/m, showing a moderate cooling in price pressures. With inflation trending lower and the Fed expected to cut rates later this year, any further downside surprise would likely reinforce bets on easing, dragging yields and USD/JPY with it.

What Would Drive USD/JPY Lower Post-CPI?

For USD/JPY to follow its stronger tendency for deeper USDJPY falls we would likely need the CPI print to come in below the market’s minimum expectations, but also watch out for any unexpected tariffs news as that will also impact the USDJPY pair.

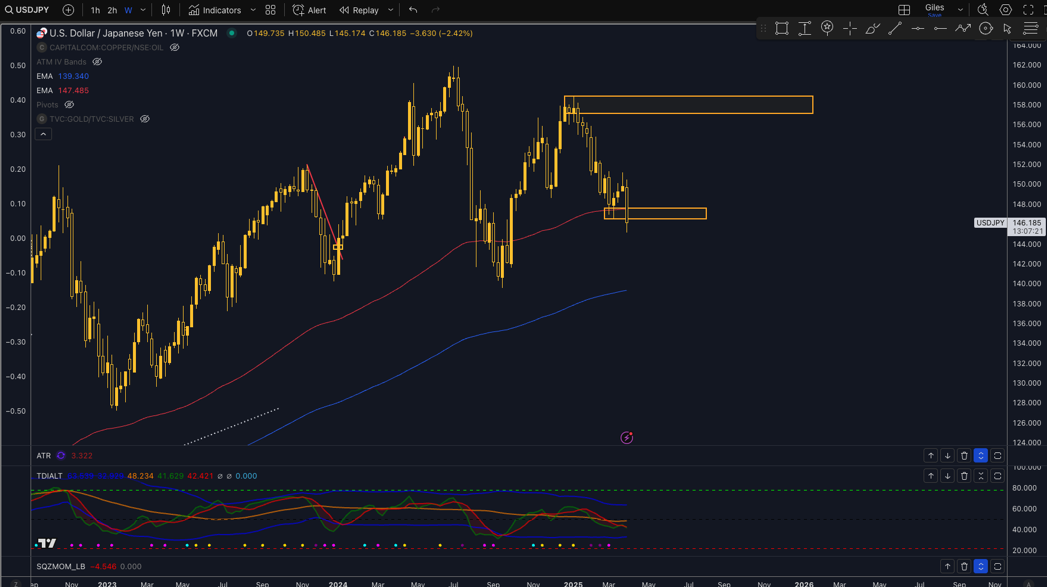

Technical Perspective

From a technical standpoint 147.00 is a crucial level for USDJPY sellers to stay under to see more downside, with 142.00 as the next major long term target for sellers.

Use Seasonax for your professional handling of market-moving events!

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade risks: The main risk is a sharp uptick in US inflation data that can send the USDJPY higher out of the print as well as any unexpected tariff news….

Don’t Just Trade It – Seasonax It!