Dear Investor,

Behavioral science and stock markets are two areas that are often moving to the top of my must-read list. I have been fascinated for years by the various drivers affecting stock prices. Often one forgets that superficially quite mundane things can exert an enormous influence on the latter.

Among the drivers that are scarcely on anyone’s radar is the weather. And what is a better month to try to predict the unpredictable than April with its notoriously fickle weather patterns?

Psychologists have examined correlations between people’s behavior and the weather for a long time, and numerous studies on the topic have been done. An interesting one I have come across is a study by Tyler Shumway and David Hirshleifer entitled “Good Day Sunshine: Stock Returns and the Weather.”

Shumway and Hirshleifer examined the relationship between morning sunshine and the daily returns of the country’s leading stock market indexes and have found strong correlations.

The weather factor plays a major role in April and is one of the best-known seasonal drivers. Sunny weather and mild April temperatures seem to have a noticeable impact on market performance by enhancing the confidence of bullish traders, who are then pushing stock prices up.

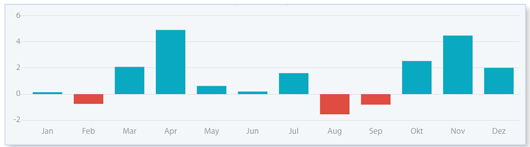

The analysis below measures the performance of the S&P 500 index in every month of the year, averaged over a 25-year period.

Average monthly return of the S&P 500 Index since 1996

Source: Seasonax

On the chart above it can be clearly seen that April has been one of the best performing months for decades. In 2020 the pattern once again repeated, as there was a sharp rebound in US stocks in April after the market bottomed on March 23. Whether the pattern will repeat again this year is hard to say, but trading psychology is often influenced by so-called self-fulfilling prophecies.

Other Major Impacts of Weather Events

Spring and warmer weather improve everybody’s mood.

But what happens to the stock market in times of inclement weather?

There is for instance the major Atlantic hurricane season that runs from June until the end of November.

While severe weather events will inflict major and quite costly damages on many companies, certain businesses will actually benefit from them. Shares in the companies concerned tend to rally during or shortly after the hurricane season.

One of these companies is AECOM – a US-based multinational engineering firm listed on the NYSE.

Over the past 20 years, severe hurricanes have made landfall in the US mostly in September and October. The increased demand for infrastructure-related work on the heels of the devastation can be clearly discerned in the seasonal chart of AECOM. The stock of AECOM enters a strong seasonal period from the middle of October until the end of November. Let us take a closer look at the statistics.

Seasonal Chart of AECOM over the past 13 years

Source: Seasonax – by clicking on the chart image you can highlight the above mentioned time period on the chart and take a closer look at a detailed statistical analysis of the pattern

Keep in mind that unlike a standard price chart that simply shows stock prices over a specific time period, a seasonal chart depicts the average price pattern of a stock in the course of a calendar year, calculated over several years. The horizontal axis depicts the time of the year, while the vertical axis shows the level of the seasonal pattern (indexed to 100).

I have highlighted the strong seasonal phase from October 10 to November 25 calculated over the past 13 years. In this time span of 33 trading days, the shares of AECOM rose on average by a remarkable 11.01 percent.

Furthermore, the frequency of positive returns generated over time during this phase indicates that this seasonal pattern is consistent and highly reliable. The bar chart below depicts the return delivered by AECOM in the highlighted time period from October 10 to November 25 in every single year since 2008.

Pattern return for every year since 2008

Source: Seasonax – please click on the link to conduct further analysis

Moreover, there are many more companies that tend to see growing sales when extreme weather prevails, as consumers seek to prepare for upcoming weather disasters.

Sales of battery manufacturers usually increase before hurricanes strike, as consumers stock up batteries that will be needed for their radios and flashlights. Furthermore, home improvement companies or companies testing the potability of water can benefit from seasonal effects on their stock prices in the aftermath of storms.

Rain or shine, the weather clearly makes a difference with respect to revenue generation. In optimizing your portfolio do not forget to consider weather as a potentially crucial parameter you can benefit from.

Keep in mind that timing the market has never been easier

Apart from the stocks I have presented in this issue of Seasonal Insights, there are numerous other stocks that display recurring seasonal patterns and/or are influenced by weather seasonality.

To make finding these opportunities even easier, we have launched a Seasonality Screener. The screener is an analytical tool designed to identify trading opportunities with above-average profit potential starting from a specific date. The algorithms behind the screener are based on predictable seasonal patterns that recur almost every calendar year.

Feel free to analyze more than 20.000+ instruments including stocks, (crypto)currencies, commodities and indexes by signing up to a free trial.

Yours sincerely,

Tea Muratovic

Co-Founder and Managing Partner of Seasonax