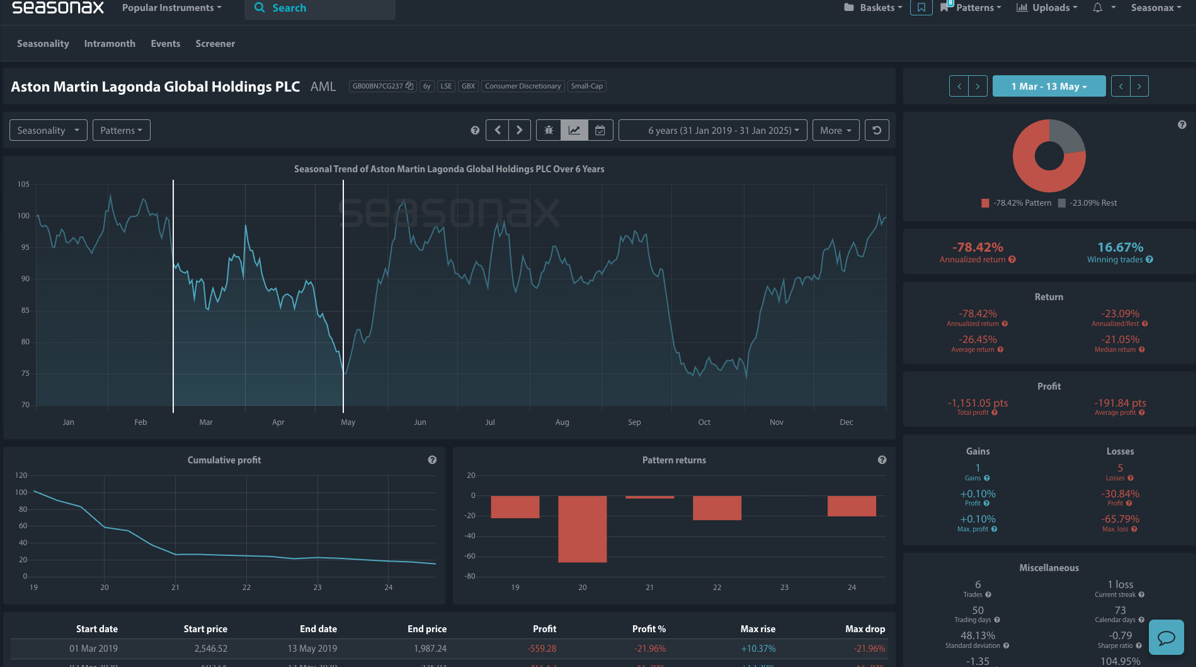

- Instrument: AML

- Average Pattern Move: -26.45%

- Timeframe: March 1 – May 13

- Winning Percentage: 16.67%

You may not realize it, but Aston Martin Lagonda Global Holdings Plc is in the midst of yet another turnaround effort, this time under new CEO Adrian Hallmark. Following years of losses, a declining order book, and multiple profit warnings, the British luxury carmaker is cutting costs and refining its strategy. The latest move—a 5% reduction in its workforce—is expected to save the company £25 million annually. However, with shares already down 35% over the past year and ongoing challenges like supply chain issues and declining Chinese demand, questions remain about the brand’s ability to reverse its long-term decline. Given these uncertainties, we want to analyze the data in more detail.

Seasonal Trends: A Cautionary Tale

The chart shows you the typical development of Aston Martin’s share price between March and mid-May over the last six years. The trend paints a highly negative picture, with an annualized return of -78.42% and a win rate of just 16.67%. Notably, losses during this period have been substantial, with an average pattern decline of -26.45%. While seasonality should never be used in isolation, this short-term pattern suggests a historically weak period for the stock.

Can Cost-Cutting Alone Turn the Tide?

Aston Martin’s restructuring under Hallmark is focused on improving profitability over volume. The company’s past strategy of aggressive expansion has led to capital raises and model delays, both of which have damaged investor confidence. The key challenge remains whether these efforts will be enough to avoid another round of fundraising, especially as the company moves away from a previously set £500 million EBITDA target for 2025.

The backdrop of potential US tariffs also looms large, threatening its biggest market. If trade barriers are imposed, Aston Martin could face further headwinds, making its turnaround even more difficult. Will this mean further downside in light of it’s seasonal bias?

Technical Perspective

From a technical standpoint there is a strong daily resistance area at 120. Will sellers use that as an area to lean against?

Use Seasonax for your professional handling of market-moving events!

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade risks

Aston Martin’s restructuring efforts may offer long-term upside, seasonality indicates a historically weak period ahead. Additionally, broader market conditions, supply chain disruptions, and geopolitical risks can all impact this outlook.

Don’t Just Trade It – Seasonax It!