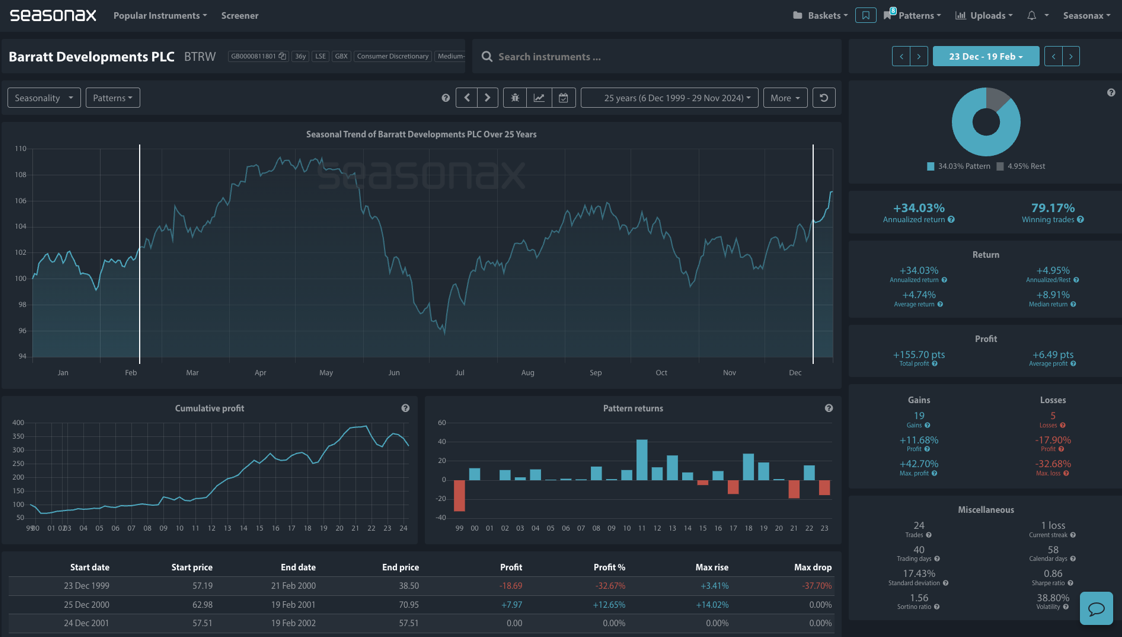

Instrument: Barratt Developments

Average Pattern Move: +9.23% (example value for illustration)

Timeframe: Dec 23 – Feb 19

Winning Percentage: 79.17%

The UK’s housing market is at the forefront of political and economic discussions following Labour’s announcement to tackle the housing shortage by building 1.5 million new homes over five years. Deputy Prime Minister Angela Rayner’s proposal to reinstate mandatory housing targets and overhaul the planning process offers a potential catalyst for major housebuilders, with Barratt Developments standing out as a key beneficiary.

As the UK’s largest housebuilder, Barratt has the scale, land bank, and operational flexibility to capitalize on Labour’s streamlined planning initiatives. The commitment to provide developers with greater certainty and speed up project approvals aligns closely with Barratt’s strategic focus on expanding supply to meet demand. Additionally, historical seasonal trends in late December through February could further amplify Barratt’s performance, with investors positioning for higher activity levels in the housing market. With a strong seasonal bias ahead and an average return of 4.74% is this a seasonal trend to ride again?

Technically Barratt’s homes has decent support around 400 – see chart below. This would be a potential area for stop placements to sit underneath.

Adding to the Momentum: Persimmon Homes

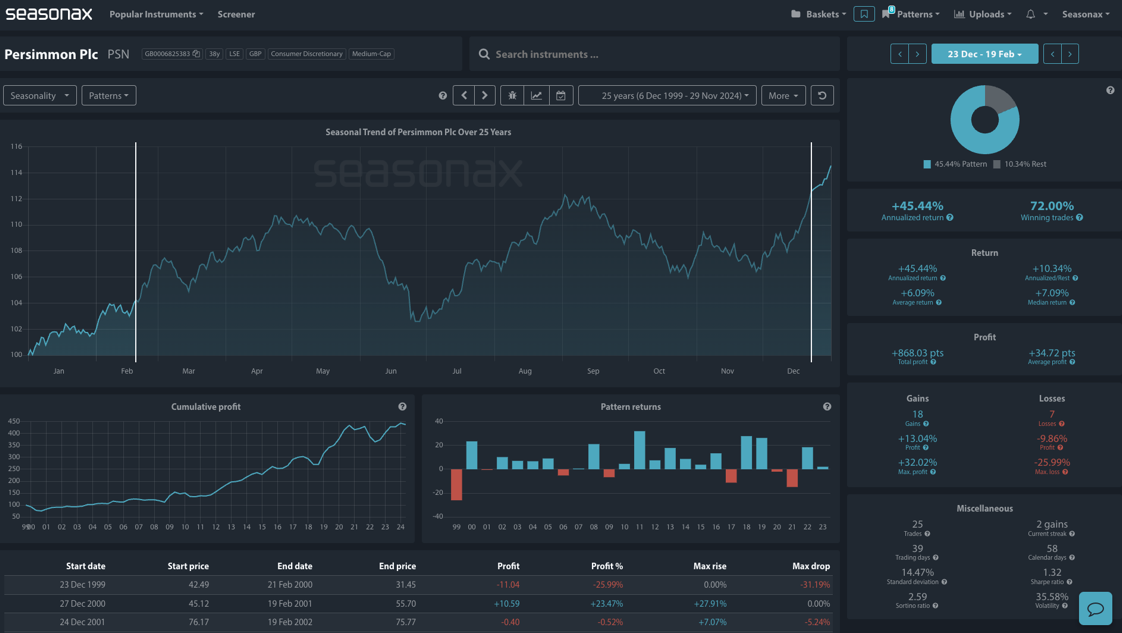

Instrument: Persimmon Plc

Average Pattern Move: +6.09%

Timeframe: Dec 23 – Feb 19

Winning Percentage: 72%

Persimmon Plc, one of the UK’s leading affordable housing developers, is another potential winner from Labour’s proposed reforms. With its strong focus on providing homes for first-time buyers, Persimmon is well-aligned with Labour’s emphasis on addressing housing shortages for key demographics. Streamlined planning processes would enable Persimmon to scale its operations more effectively in high-demand regions.

Historically, Persimmon has also demonstrated strong seasonal performance, with an annualized return of +45.44% over the past 25 years during the December-February period and an average return of +6.09%. This trend, coupled with political tailwinds, positions Persimmon for a strong start to 2024.

Technically Persimmon has a large support area around 1000 which could offer a decent area for a potential entry with stops just running below 800.

Conclusion

With Labour’s reforms aimed at accelerating housing development, Barratt Developments and Persimmon Plc stand out as key beneficiaries, leveraging both their market presence and operational efficiencies. As seasonal trends align with these structural catalysts, will these housebuilders capitalize on the opportunity to meet the UK’s ambitious housing targets and deliver gains for investors?

Trade Risks

Previous seasonal trends and political promises are not guarantees of future performance. Also, any interest rate changes from the Bank of England will also strongly impact the UK housing market.

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade Risks

While historical data points to consistent profitability, external market factors could still influence outcomes.

Don’t Just Trade It – Seasonax It!