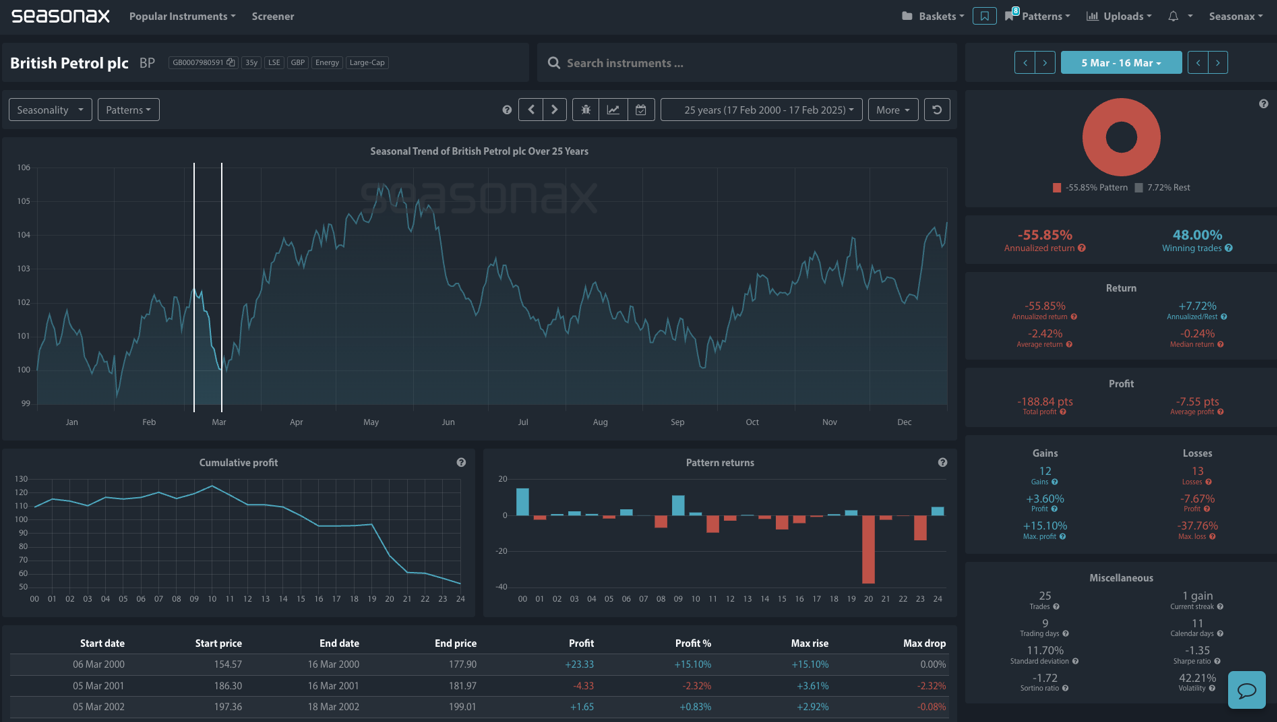

- Instrument: BP plc

- Average Pattern Move: +5.57%

- Timeframe: March 15-May 20

- Winning Percentage: 76%

Market Analysis and Drivers

BP is navigating heightened activist pressure following Elliott Management’s involvement, calling for strategic rollbacks and cost-cutting initiatives to unlock shareholder value. Analysts note that despite previous missteps in the energy transition, BP remains a key player in the global oil and gas sector, with undervalued assets and a strong cash flow profile.Goldman Sachs estimates BP could sell off assets worth $26 billion as a strategy to reduce its debt burden if it so wished.

Seasonality adds to this perspective—historically, mid-March through May has been a strong period for BP’s stock, posting a +34.94% annualized return with a 76% win rate. This seasonal trend aligns with broader commodity price strength, potential corporate restructuring momentum, and increased shareholder-focused initiatives.

With energy prices still volatile, BP’s upcoming capital allocation decisions will play a critical role in whether it rides the seasonal wave higher or faces renewed selling pressure. Also, note that there is a weaker period ahead with an average loss of -2.47%. However, could this provide a dip buying opportunity?

Technical Perspective

From a technical standpoint there is a strong monthly support area around 400 which could be an attractive place for any dip buyers.

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade risks

While BP’s seasonal trend suggests a strong bullish bias, risks include oil price volatility, activist-driven uncertainty, FTSE-100 sensitivity, regulatory pressures, and potential deviations from historical patterns.

Don’t Just Trade It – Seasonax It!