BP’s latest earnings, released on Tuesday this week, saw both it’s quarter profits and cash flow fall more than expected. Operating cash flow, standing slightly above $5 billion, marked its lowest point since Q4 2020, significantly falling short of the average analyst projection of $6.72 billion. Meanwhile, net debt surged by over $3 billion, reaching $24.02 billion by the close of the first quarter. BP attributed these numbers to a $2.39 billion increase in working capital, with the expectation that the majority of this impact will be reversed by the conclusion of the third quarter.

So, with BP making fresh pledges to reduce costs in the medium term and plans to deliver over $2 billion in cash savings by 2026 is any dip worth buying? Taking a look at the seasonal pattern for BP we can see that there is a summer slide ahead. Over the last 25 years BP share prices have fallen over 52% of the time for an average drop of 5.26%. The largest fall has been nearly 30% in 2015.

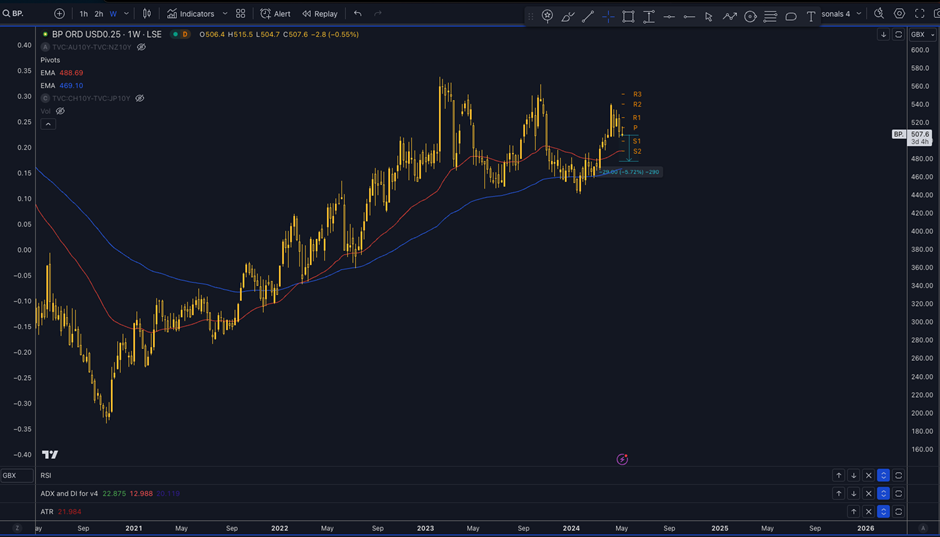

Technically, BP’s share price sits over 5.5% above it’s 200 EMA on the weekly chart, so does that mean this is a dip worth buying?

Giles Coghlan, CMT is a seasoned financial writer specialising in macro outlooks and key technical trading strategies

Sign up here for thousands of more seasonal insights just waiting to be revealed!

The major trade risk here is that BP’s share price finds dip buyers and/or oil market volatility on the Middle East crisis boost BP’s share price.

Remember, don’t just trade it Seasonax It!