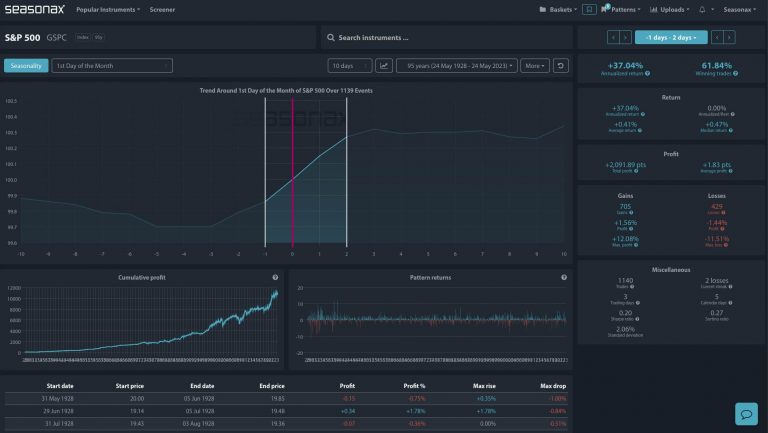

The US Midterm elections have a very strong seasonal pattern that you need to be aware of. Since 1950 the US midterms have resulted in gains 83% of the time between November 20 and December 30,

Now, if you extend that pattern out to April 30 the US midterm elections have resulted in gains every single time. That is a win percentage of 100% going all the way back to 1950. So, if you want to be ahead of the curve in terms of the US midterm elections the long view favours buyers.

So, regardless of the US midterm election outcome, does it make sense to buy the S&P500 ?

Major Trade Risks:

The major trade risk here is that previous seasonal patterns are not guaranteed to repeat each year even with a 100% previous track record.

Remember, don’t just trade it, Seasonax it.