Chevron is a US energy integrated company with exploration and refining operations across the globe. It is the second largest US largest oil producer behind ExxonMobil.

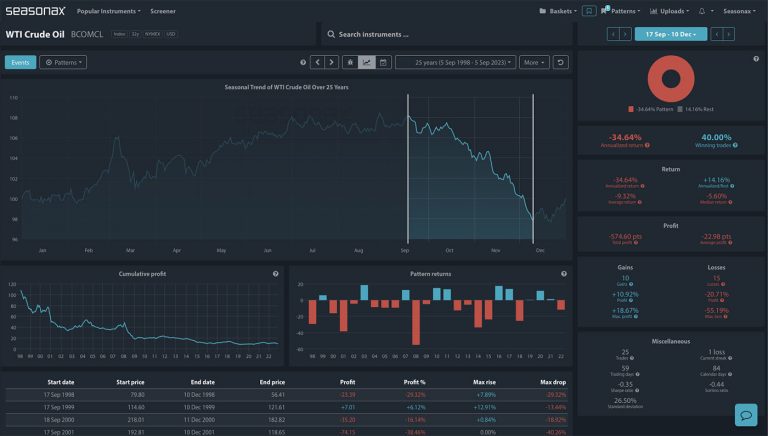

Now, oil markets have been relatively subdued over recent months which has been helping with inflationary pressures. However, some analysts see the potential for a tight oil market in the second half of 2023. With OPEC+ production cuts, China demand expected to return post Lunar New Year and Russian oil price caps the oil market could see some gains over the next few weeks.

Does this make Chevron a good stock to buy ahead of a strong seasonal pattern it has? Or are prices too high?

Over the last 25 years Chevron has gained 19 times between February 07 and May 03. The largest gain was in 1999 with a 25% surge and the largest fall was in 2020 with a 15% loss. Is this the time to start buying into Chevron ahead of earnings which are announced on Friday before the US Open?

Major Trade Risks:

The major trade risk here is that oil market’s don’t tighten as analysts expect and that Chevron’s earnings hold some negative surprises for the stock.

Remember, don’t just trade it, but Seasonax it!