China’s housing market has been a significant drag on the economy for the past few years, with the country battling to revive a sluggish property sector. Recent reports suggest that China is weighing the removal of major home buying restrictions, especially in megacities like Shanghai and Beijing, to boost demand. This move is part of a broader effort to stabilise the market and hit the 5% growth target set by the government.

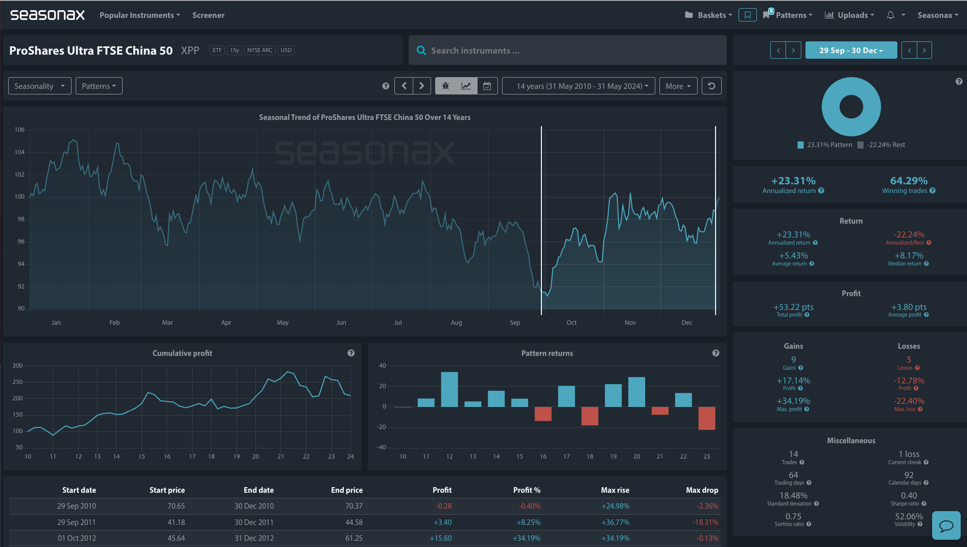

Despite this economic uncertainty, the ProShares Ultra FTSE China 50 ETF shows a seasonal uptrend between September 29 and December 30, with an impressive 23.31% annualised return over the past 14 years. The ETF has delivered gains 64.29% of the time during this period, making it a compelling option for investors looking to capitalise on potential positive developments in China’s economy.

However, risks remain. China’s economic growth target of 5% appears increasingly difficult to achieve, with major financial institutions expecting the country to miss this goal. The slump in housing has also been compounded by weak consumer spending and a fragile labor market.

Technically the China 50 is hovering above key daily support at 10,500 marked in blue on the chart below. So, this would be a reasonable place for medium term buyers to step in.

As China works to stabilize its housing market and economy, the ProShares Ultra FTSE China 50 ETF could offer an opportunity to benefit from potential policy-driven upside. However, investors should remain cautious and monitor developments closely.

Trade risks: The primary risk is that the seasonal trend may not repeat, and especially if the anticipated reforms fail to materialize or if China’s broader economic conditions deteriorate further.

Sign up here for thousands of more seasonal insights just waiting to be revealed!

Remember, don’t just trade it—Seasonax it!