China Resources Land Limited (CR Land) is a prominent real estate development company in China. It is a subsidiary of China Resources Holdings Company Limited, a state-owned conglomerate. The company’s activities include: Property development, property investment, management, and urban redevelopment. The company invests in and manages a portfolio of investment properties, including shopping malls, office buildings, and hotels. These properties generate rental income and are strategically located in key cities across China. In addition to its real estate activities, CR Land also operates commercial businesses, including department stores, supermarkets, and hotels, leveraging its real estate assets to generate additional revenue streams. China Resources Land Limited plays a significant role in the real estate market in China, focusing on developing high-quality properties and providing comprehensive property management and investment services. However, China’s property sector has been struggling for a number of reasons including: high debt levels, falling sales and property prices, and some oversupply of housing stock in some regions. Furthermore, China’s overall economic growth has been slowing partly due to the impact from COVID-19 and other global economic uncertainties.

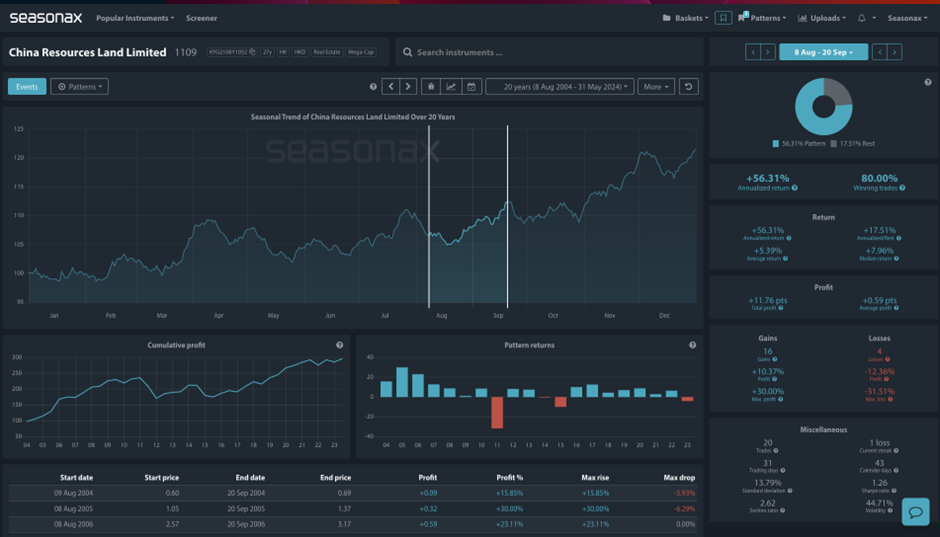

So, this seasonal pattern may not apply this year, but if this is the time for a recovery could we see China Resources Land Limited strong seasonal pattern play out? Over the last 20 years the share prices has risen 80% of the time for an average return of 5.39%.

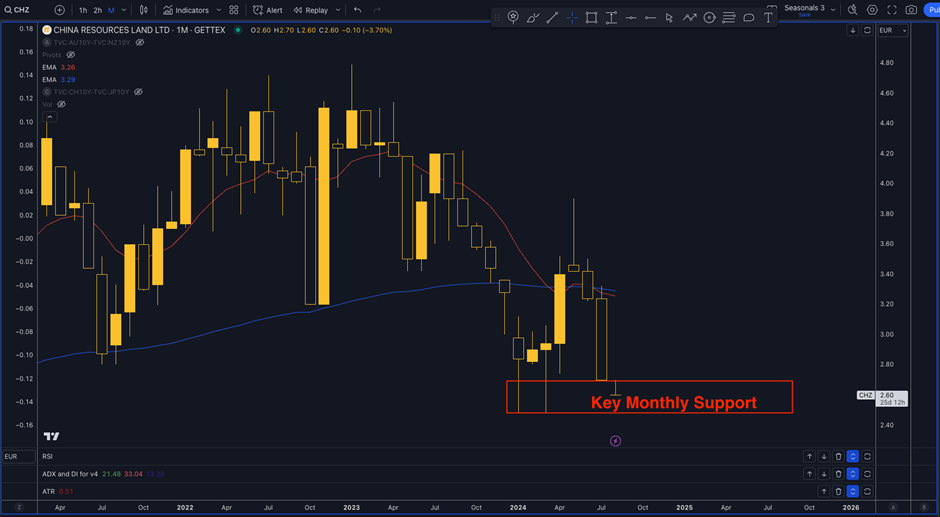

Technically, there is strong monthly support marked around 2.60 on the chart marked below. Could this provide support for any buyers betting on a recovery in prices and China’s property sector?

Sign up here for thousands of more seasonal insights just waiting to be revealed!

Trade risks

- Previous seasonal patterns do not guarantee future seasonal patterns and China’s struggling property sector may continue to struggle.

Remember, don’t just trade it Seasonax It!