EasyJet Plc has announced plans to more than double its dividend this year, reflecting robust progress driven by record summer performance, reduced winter losses, and surging demand for its package holiday business. The airline’s board proposed an ordinary dividend of 12.1 pence per share, a significant increase from 4.5 pence last year, with 20% of the payout planned for March.

CEO Johan Lundgren highlighted “very strong progress” across nearly all metrics, supported by EasyJet’s holiday business, which is forecast to grow by 25% next year amid booming demand for hassle-free UK vacations. Shares rose by up to 3.3% in early London trading, reflecting investor optimism.

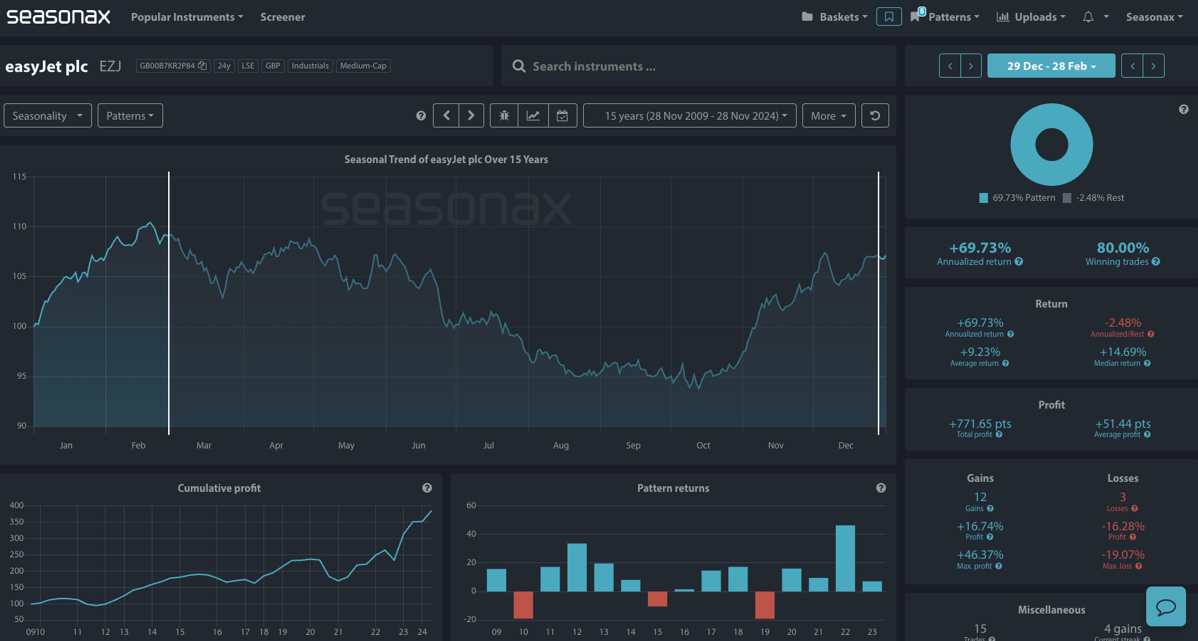

This performance ties closely to EasyJet’s historical seasonal trends. According to Seasonax, the airline demonstrates a strong seasonal pattern between late December and February, with an annualized return of +69.73% and an 80% win rate over the past 15 years. The December-February period has historically been a key driver of cumulative profits, as shown by the consistent pattern of gains during this time. Average and median returns of +9.23% and +14.69%, respectively, reinforce this trend.

The strength of this seasonal pattern aligns with EasyJet’s operational improvements, including its ability to reduce winter losses. Additionally, the airline’s strategic choice of an all-Airbus SE fleet has insulated it from the supply chain disruptions affecting rivals like Ryanair and Wizz Air, positioning it to capitalize on the robust demand for winter travel.

As the company transitions leadership from Johan Lundgren to CFO Kenton Jarvis next year, EasyJet’s ability to sustain its seasonal strength becomes a pivotal question. Will EasyJet’s seasonal performance this winter align with its historical patterns and capitalize on the projected growth in holiday demand, or will external pressures such as economic uncertainty and market competition dampen this momentum?

Technically, there is a very strong support level at 440 as a decent area for potential entries/stop placements.

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade risks

Previous seasonal patterns do not guarantee future seasonal moves.

Don’t Just Trade It – Seasonax It!