- Instrument: EUR/USD

- Average Pattern Move: +0.54%

- Timeframe: March 10 – March 17

- Winning Percentage: 75.00%

Dear Investor,

You may not realize it, but analysts have been talking about the narrative of US economic exceptionalism fading, providing potential upside for EUR/USD. Worries over slowing US growth, fiscal concerns, and narrowing yield differentials are challenging the Fed’s expected rate path, making the dollar vulnerable to further weakness. Meanwhile, Europe’s fiscal expansion, particularly through increased defence spending, is supporting economic activity, a notable shift from past austerity. We want to analyze the data in more detail.

Seasonal Tailwinds for EUR/USD

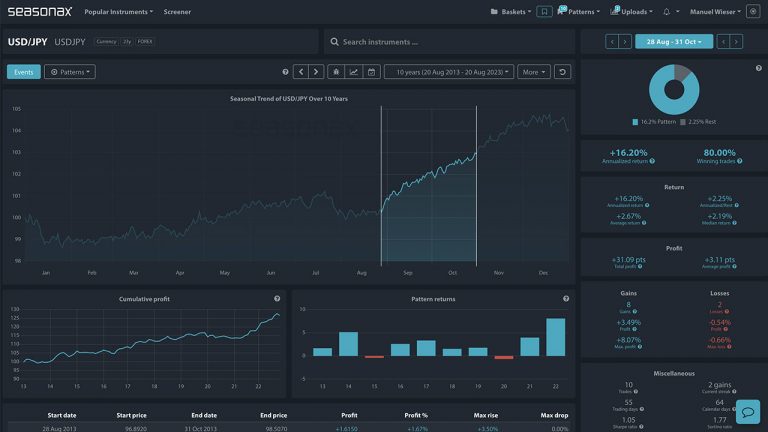

The chart shows you the typical price behavior of EUR/USD from March 10 to March 17 over the past 20 years. Historically, this period has delivered an annualized return of +32.26%, with the pair rising 75% of the time. The seasonal strength aligns with shifts in global capital flows, as markets recalibrate expectations around monetary policy and fiscal dynamics.

Yield Differentials and Policy Shifts

The narrowing US-German 10-year yield spread is a crucial driver behind recent euro strength. Declining US Treasury yields, coupled with resilient Bund yields, provide a tailwind for EUR/USD. Additionally, Europe’s fiscal expansion, particularly with higher defence spending, supports growth and helps counterbalance past economic stagnation. This backdrop reduces downside risks for the euro, especially if US economic data continues to soften.

Use Seasonax for your professional handling of market-moving events!

Technical Perspective

From a technical standpoint there is a commanding weekly candle breaking through the 100 and 200 EMA. Will dip buyers step in on any drops lower?

Use Seasonax for your professional handling of market-moving events!

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade risks

Despite the bullish seasonal trend, key risks remain. A stronger-than-expected US inflation print or hawkish Fed rhetoric could revive dollar strength, putting pressure on EUR/USD. Additionally, geopolitical developments, particularly surrounding Europe’s energy security and US fiscal debates, could introduce volatility.

Don’t Just Trade It – Seasonax It!