The EUR/USD is in focus as the market awaits the upcoming Nonfarm Payroll (NFP) report and its potential impact on Fed policy. Seasonal data indicates that the EUR/USD has an average annualized return of +3.04% in the 10-day period surrounding U.S. NFP announcements, with a slightly favorable winning trade percentage of 53.98%. This suggests that the pair historically sees moderate strength following these data releases, but the outcome will largely depend on the NFP’s specifics. This is where the Seasonax event feature is very useful for showing the sort of ranges to expect. With pricing roughly 50/50 as to whether the Fed cut by 25 or 50bps at their next meeting there are two way opportunities here.

What Could This Mean for the Dollar?

– Weak NFP Print: Should the upcoming NFP report show weak figures (such as payroll numbers below 94K, unemployment rising to 4.4% or higher, and average earnings growing at only 0.2% or less), this would solidify expectations for a 50bps rate cut by the Fed. In this scenario, we could see the dollar weaken, leading to a sharp rally in EUR/USD. Historical seasonality supports this view, with gains often following weaker job data. The DXY could potentially break lower, targeting the 99.50 level. There have also been a 3 occasions when the EURUSD has gained a full percentage point on the NFP.

– Strong NFP Print: On the other hand, a strong NFP report (with numbers exceeding 200K, unemployment at 4.0% or lower, and earnings at 0.4% or higher) could challenge the narrative of an aggressive rate cut. This would likely lead to dollar strength, triggering a sell-off in EUR/USD. Gold prices and other dollar-denominated assets would likely weaken, with U.S. bond yields rising. Given the dollar’s current stretched downside positioning, this could spark a sharp corrective rally. We can see that some of the steepest EURUSD falls have all been under 1% and tended to be pre 2020.

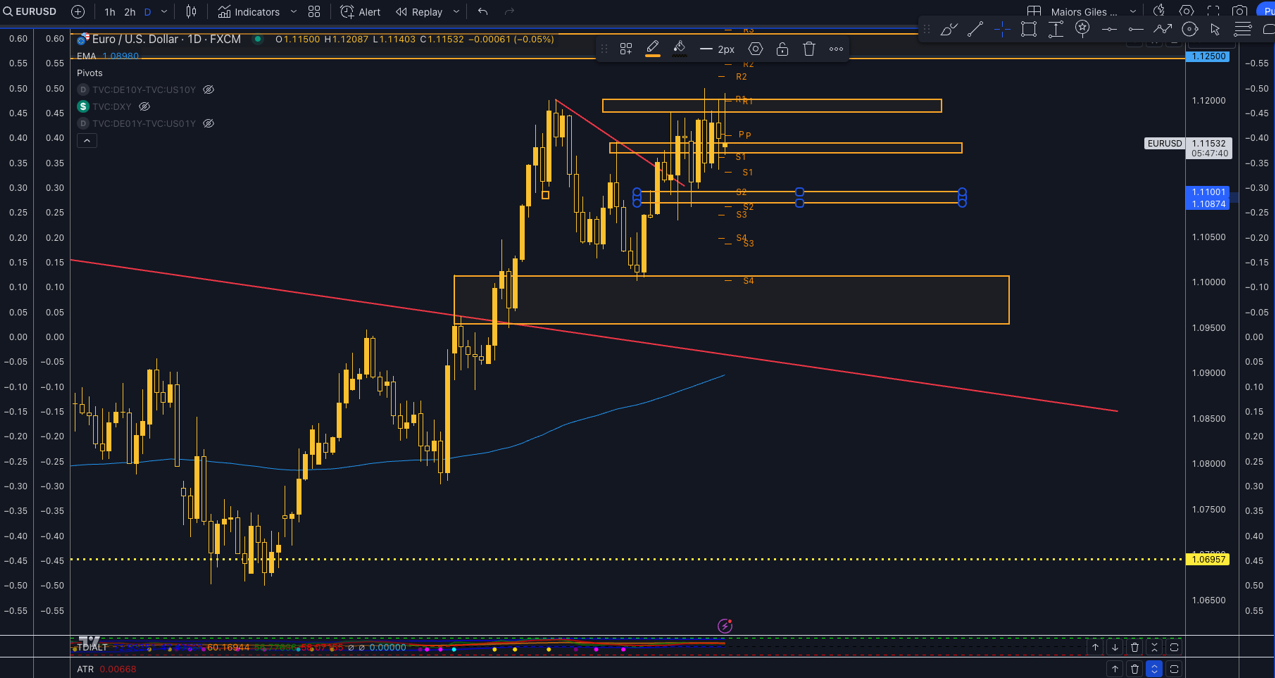

Technically, the EURUSD has major resistance levels at 1.1200 and 1.1250 and major support at 1.1100 and 1.1000

Conclusion

The NFP report will be a critical factor in determining the dollar’s next move. While seasonal trends indicate a modest upside for EUR/USD around NFP events, the actual market reaction will hinge on the report’s strength. Traders should watch for an out of consensus print and the event feature from Seasonax to set maximum expectations for moves!

Sign up here for thousands of more seasonal insights just waiting to be revealed!

Trade risks

The main risk here is that previous moves are not exactly repeated as they have been in the past.

Remember,

Don’t just trade it—Seasonax it!