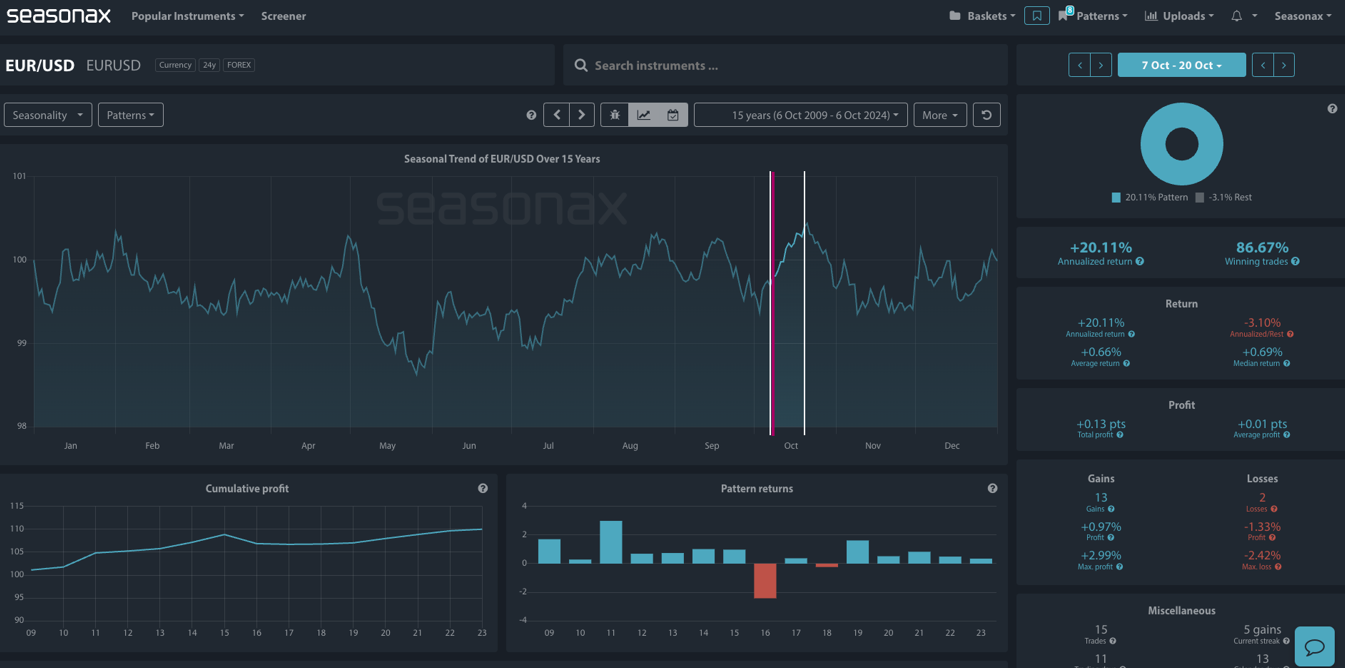

The recent strong Non-Farm Payrolls (NFP) data from October 04 and ongoing dollar strength on geo-political risk suggest that short-term USD appreciation may continue. However, seasonal trends indicate a potential bias for EUR/USD buyers over the next couple of weeks. Historically, EUR/USD has shown a +20.11% annualized return from October 7 to October 20 over the past 15 years, with an 86.67% win rate during this period. This suggests that despite near-term dollar strength, there may be opportunities for euro buyers.

What Could Drive This Bias?

Despite the dollar’s recent gains fueled by a robust labor market and speculation of only a 25 bps Federal Reserve rate hike (vs hopes of a 50bps rate cut last week), the seasonal data implies that EUR/USD may see upward momentum. Traders might take this historical bias into account, especially if the euro approaches major support levels. This potential rally could also be influenced by factors such as shifts in short-term interest rate expectations and geopolitical events, which can quickly alter market sentiment. Majors support sits at 1.0900 as marked below on the monthly chart.

Sign up here for thousands of more seasonal insights just waiting to be revealed!

Trade risks

Monetary policy shifts from either the eurozone or the US can shift this outlook, including geo-political risk which tends to find USD support.

Remember, Don’t just trade it—Seasonax it!