On Wednesday we have the US CPI print which is coming at a pivotal time. Since the Fed’s meeting last week and the result of the US election the USD has been moving higher but will likely need to search for a clear catalyst for conviction on further moves. With STIR market pricing and market pricing agreeing on the near term direction of just one more rate cut to come from the US a surprise print in the US CPI data could be the shift the market needs.

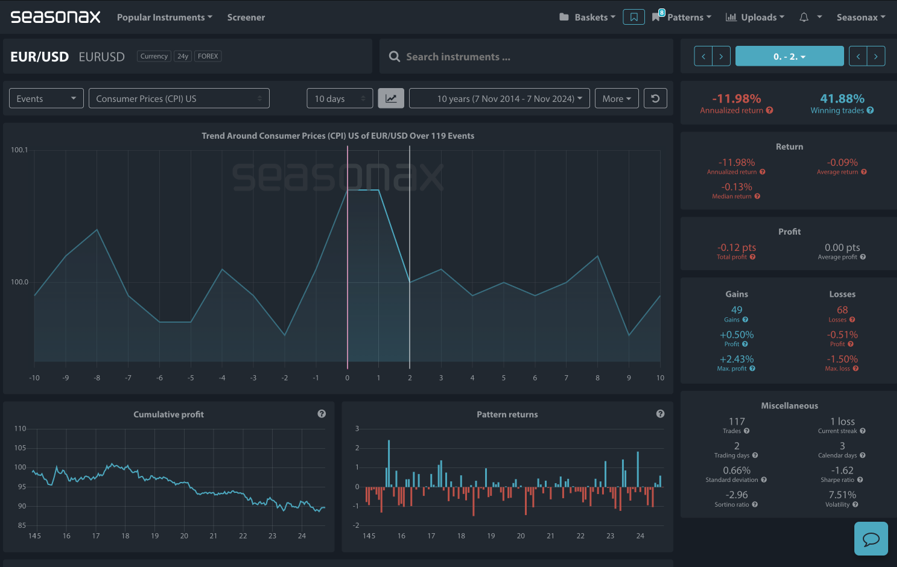

Seasonax’s event feature shows a really nice bias for EURUSD strength into CPI prints with a EURUSD long win bias of 60%.

Now the US CPI print for Wednesday is expected to tick up to 2.6% from 2.4% prior and the core is due to stay at 3.3%. So, it is also worth being aware that should that CPI print surprise above the market’s expectations 3.5% for the core y/y and 2.7% y/y for the headline then there could be some more USD strength on re-pricing over the need for the Fed to hold rate higher for longer. That would be USD positive (and EURUSD negative). So, it is also worth noting the event bias for EURUSD downside in the 2 days after the US CPI print. The largest fall has been 1.50%, so a big beat in the US CPI print could be the sign for more EURUSD selling!

Technically, there are major support and resistance levels marked below which will provide natural target and turn around levels for the EURUSD. These are the noteworthy levels traders will be eyeing around the US CPI event and can be useful to help with targets and stop placements.

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade risks

The main risk is from USD moves on President elect Trump’s proposals for his upcoming US Presidency.

Don’t Just Trade It – Seasonax It!