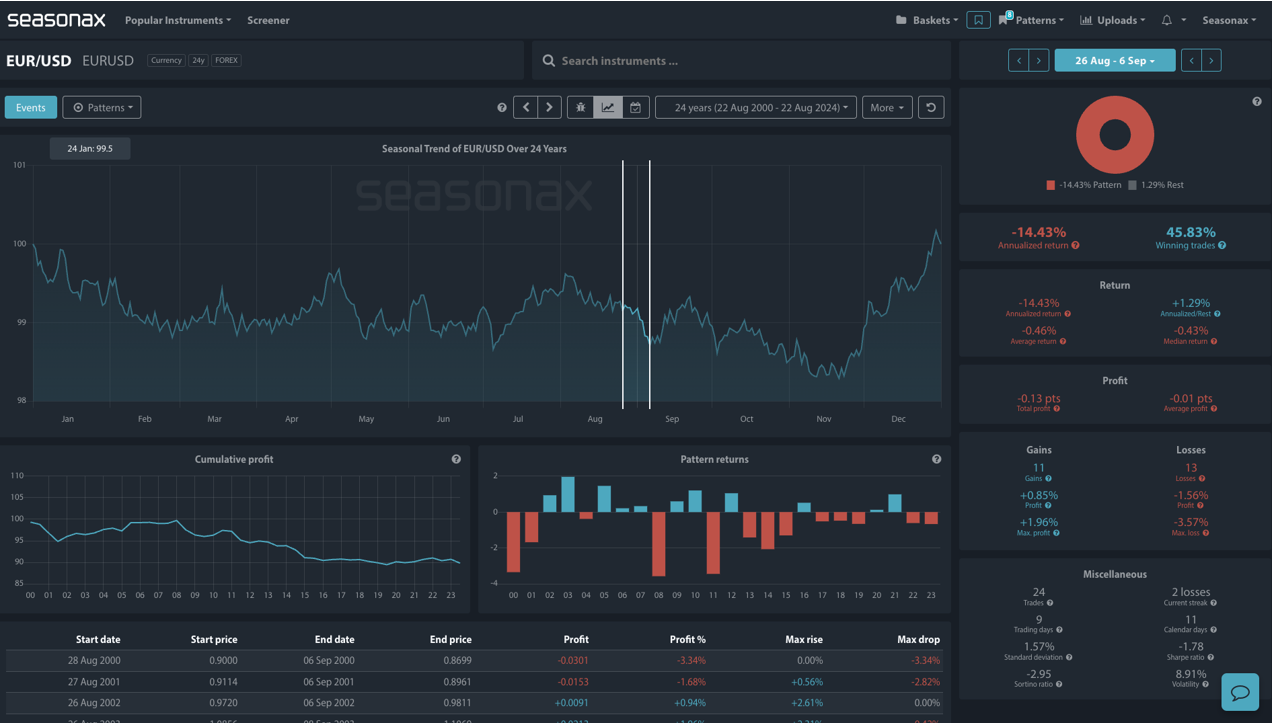

The seasonal chart for the EURUSD is painting a picture of EURUSD downside ahead, with some outsized falls seasonally recorded in the pair. Over the last 24 years the pair has had falls over 3% three times. The largest fall was during the Global Financial Crisis in September 2008 when the EURUSD fell 3.57% as the USD found safe haven bids.

With the EURUSD having made decent gains in anticipation of coming rate cuts from the Fed is now the time for a seasonal retracement?

Technically the 1.1250 level sits overhead and could be an obvious place for profit takers. Also, next week also sees the US PCE print on Friday and a hot print could strengthen the USD and send the EURUSD lower. Remember, the Fed will still be very sensitive to incoming inflation data and a big beat in the data will have markets rapidly price out the 4 interest rate cuts currently expected.

Sign up here for thousands of more seasonal insights just waiting to be revealed!

Trade risks

As always, while seasonal patterns provide valuable insights, it is crucial to consider the current macroeconomic environment, geopolitical factors, and broader market trends to complement this historical perspective.

Remember, don’t just trade it Seasonax It!