Dear Investor,

I hope that you have had a good start to the new year, and that you know health and stock market success in 2023!

First of all, there is good news for Seasonax users at the beginning of the year. Seasonax is planning to introduce a brand new feature this month: event studies.

Have you ever wondered how stock or commodity prices will behave when futures contracts expire, and when labor market or inflation numbers are published, or when the Fed meets for its FOMC meeting?

As a Seasonax user, this month you will probably be able to find the answers to these questions, as well as many others, all with just a few mouse clicks!

This is a completely new feature, analogous to the annual seasonality you are familiar with, and which will allow you to improve your investment results even further.

So what are event studies?

I would like to show you what event studies are all about using a simple example of FOMC meetings.

Probably the most important issue for stock market participants last year was high inflation rates, and the increase in key interest rates by the U.S. Federal Reserve to combat inflation.

But how do stock prices behave when key interest rates are raised? Is there an empirical correlation that you can use as an investor?

This is how often the FED decides on interest rate hikes

Eight times a year, the Federal Open Market Committee (FOMC) of the U.S. Federal Reserve meets to discuss and decide on monetary policy, and the level of key interest rates.

In view of the continuation of high inflation rates, most recently 7.1%, it is generally expected that a further increase in key interest rates will be decided at the upcoming FOMC meeting. The next FED meeting is scheduled for the turn of this month, January 31 to February.

How do key interest rate hikes affect stock prices?

To answer this question, we will examine the impact on the S&P 500 by looking at the typical course of stock prices before and after the second day of the FED meeting. This is the day on which the interest rate decision is announced.

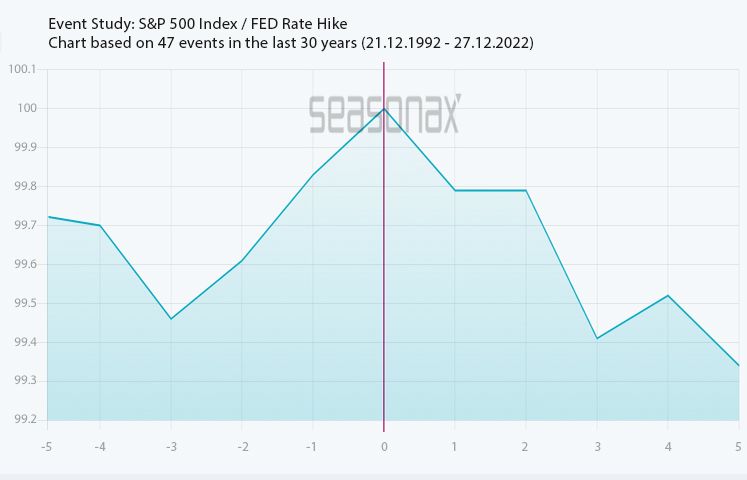

The event chart below shows the average course of the S&P 500 in the five trading days before and after the second day of the FOMC meeting.

The chart was calculated over the past 30 years, during which there have been 47 interest rate hikes. The horizontal axis shows the number of days before, and after, the second day of the relevant FOMC meeting. The vertical axis shows the average trend in percent.

The orange line marks the day of the rate hike. In this way you can see at a glance what the typical course of US share prices looks like around key interest rate increases.

Average performance of the S&P 500 five trading days before and after interest rate hikes at FOMC meetings (1992 to 2022)

Source: Seasonax

As you can see, stock prices rise three days in advance of the rate hike announcement (by 0.61% on average).

Then they move slightly downwards for two days.

Only on the third day do they react to the interest rate hikes with a relatively sharp decline.

For you as an equity investor, purchases of stocks are thus statistically more favourable several days before or after the rate hike decision, rather than at the time of the FOMC meeting.

You can use this effect as a trader, but also as a long-term investor, to improve your entry timing.

Furthermore, if you use the event feature of Seasonax in the future, you can select a different number of trading days, or a different calculation period. Many event effects last longer than three days. You can also select other instruments such as currencies or commodities, and other events such as economic data releases.

An overview of FOMC meeting dates

Of course, subsequent FED meetings are also of importance, and therefore this is a full list of this year’s FOMC meeting dates.

FED meeting dates 2023:

FOMC meeting January/February: 31/1.

March FOMC meeting: 21-22.

May FOMC meeting: 2-3.

June FOMC meeting: 13-14.

July FOMC meeting: 25-26.

September FOMC meeting: 19-20.

October/November FOMC meeting: 31/1.

December FOMC meeting: 12-13.

FOMC meeting dates for 2024 are expected to be released in June 2023.

Seasonax event studies can further improve your investment results

As you can see, event studies are a brand new Seasonax feature that can help you further improve your investment results.

We are currently in the testing phase and plan to release the event studies before the end of January. We will inform you of this in a separate email.

Of course in the meantime, it is still worthwhile for you to look for good investment opportunities with the seasonality you are familiar with on Seasonax, and increase the probability of good investment results.

So take a look again at www.seasonax.com.

Warm regards,

Dimitri Speck

Founder and Chief Analyst of Seasonax

PS: At Seasonax there is no standing still – with these event studies we continue to expand our scope of services for you!