Generally speaking two sectors that do well in a US recession are health cares stock and consumer staples stocks. Although consumers disposable income may fall they will still make consumer staple purchases, but often in more discount focus stores like Walmart and Costco.

The health care sector still remains robust in a recession since consumers still keep up health care payments and prioritise health treatments as far as possible.

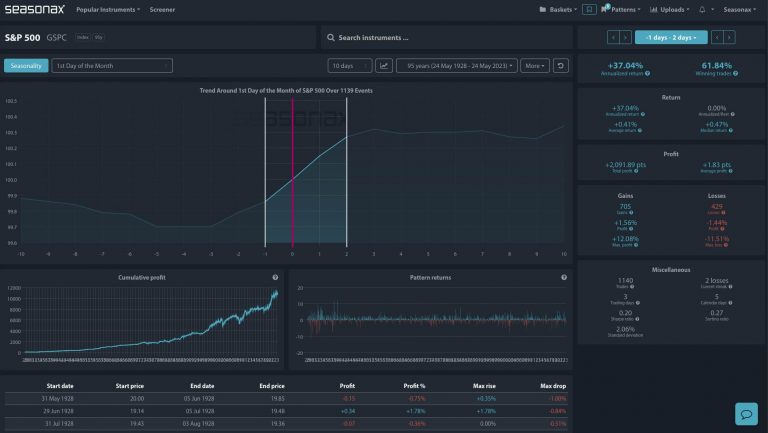

You can use Seasonax to screen these different sectors of the S&P500 in order to find strong seasonal patterns like the one noted here in Gilead sciences

Major Trade Risks:

The major risks are from any particularly negative news for Gilead sciences.

Analyse these charts yourself by going to seasonax.com and get a free trial! Which currency pair, commodity, index, or stock would you most like to investigate for a seasonal pattern?

Remember, don’t just trade it, Seasonax it !