The “first day of the month” effect in the S&P 500 refers to the observed tendency for stock returns to be higher on the first trading day of the month compared to other days. This phenomenon has been seen in various financial markets and is of particular interest to traders. The reasons for the effect are varied from month end portfolio rebalancing and automatic investments – Many retirement accounts (e.g., 401(k) plans in the U.S.) and investment plans are structured to purchase assets on the first day of the month. This steady stream of buying can create upward pressure on stock prices. There can also be month end window dressing whereby some fund managers sometimes sell underperforming stocks and buy well-performing ones to improve the appearance of their portfolios in monthly reports. This could lead to an initial dip followed by a rebound on the first day of the new month when normal trading resumes. Whatever the reason the first day of the month impact is clear.

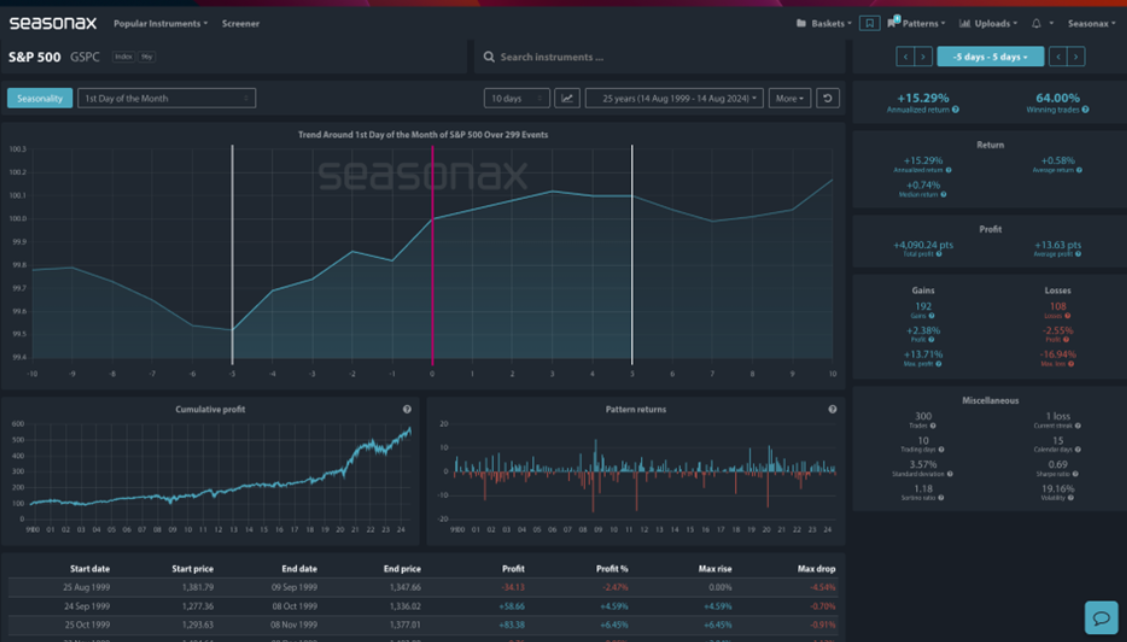

Seasonax shows an analysis of the “first day of the month” effect on the S&P 500 index over the last 25 years, from August 1999 to August 2024. The chart tracks the performance around the first trading day of the month, starting from 5 days before the start of the month, indicating an annualized return of +15.29% and a 64.00% winning trades ratio.

The cumulative profit graph, in the bottom left of the image below, shows consistent growth over time, suggesting that this pattern has been profitable in the long run. Out of 300 trades, 192 were gains, and 108 were losses, with a median return of 0.74% and an average loss of -2.55%.

The S&P500 has been trying to bottom out since the large hammer reversal on the weekly chart. Key trend line resistance/potential support on a break lies ahead – marked on the chart below.

Sign up here for thousands of more seasonal insights just waiting to be revealed!

Trade risks

This pattern does not work every time as seasonal pattern do not necessarily repeat themselves very year

Remember, don’t just trade it Seasonax It!