The upcoming UK GDP print on Friday, December 13@ 0700UK, will be critical as it provides a snapshot of the economy’s health amid high services inflation, elevated interest rates, and slowing global demand. Markets and policymakers will closely watch the data to gauge whether the UK is edging closer to a recession or maintaining fragile growth, influencing both fiscal policies and the Bank of England’s future rate decisions.

A sharp move lower in the GDP print should mean that the GBP falls on expectations of the Bank of England needing to move more quickly to interest rate cuts to support a struggling economy. Looking at Seasonax’s event feature you can see the sort of moves that can be expected in the event of a big miss. The largest drop was 1.88% in September 2024, when the UK GDP missed expectations. In March 2020 there was a drop on 1.27% and in May 2020 a drop of 0.99%. So, if we see a surprise miss, below market’s expectations on Wednesday, could that mean a fall in the GBP of 1%? It is certainly something to watch for. However, we must also remember the dynamic/driver for the USD at the time as that can amplify or limit moves depending on the sentiment at the time.

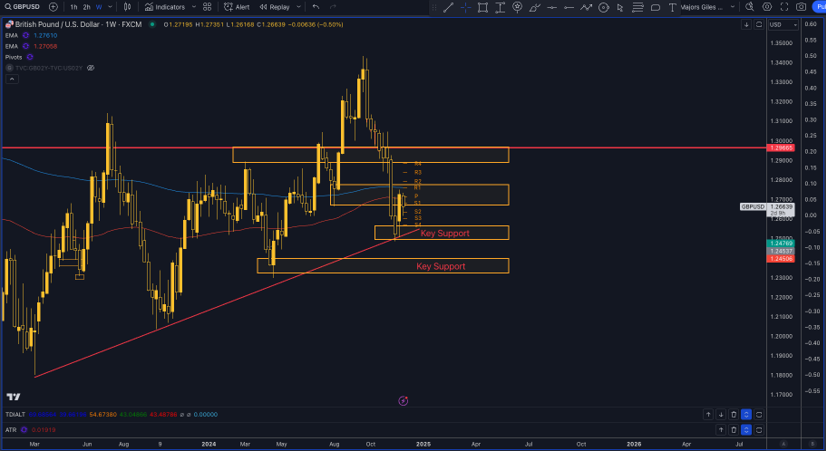

Technically, there are major weekly levels marked below at 1.2400, 1,2500, 1.2800 an s well as 1.3000. The weekly trend line from February 2023 is also marked in red and is a major reference point to note.

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade risks

The main risk is on the event release and the uncertainty of what the GDP print will be.

Don’t Just Trade It – Seasonax It!